Animal Feed Market Analysis by Type (Fodder, Forage, and Compound Feed); by Raw Materials (Soya, Corn, Rendered Meat, and Others); by Livestock (Swine, Aquatic Animals, Cattle, Poultry, and Others); and by Distribution Channel (Direct Selling, and Distributor)-Global Supply & Demand Analysis & Opportunity Outlook 2023-2035

-

Product Code:

RP-ID-10352488 -

Published Date:

3 Nov 2022 -

Region:

Global

-

Category:

Agriculture -

Publisher:

Pub-ID-54

Impact Analysis on the Growth of Market

Inflation and Looming Recession to Haunt Businesses:

In 2022 & 2023, market players expected to sail in rough waters; might incur losses due to huge gap in currency translation followed by contracting revenues, shrinking profit margins & cost pressure on logistics and supply chain. Further, U.S. economy is expected to grow merely by 3% in 2022.

....

The Research Report is Updated with 2022 Base Year, 2023 Estimated year and Forecast till 2035 with Market Insights.

With the dip in global production, the GDP has contracted in 2020 and impacted the market across the world. Upon placing a Sample Request, you will receive an updated report with 2022 as base year, 2023 as estimated year and forecast to 2035. This will have market drivers, recovery rate in the market, insights and competitive analysis.

Market Overview:

Translate Report

Global Animal Feed Market Scope Report

|

Base Year |

2022 |

|

Forecast Year |

2023-2035 |

|

CAGR |

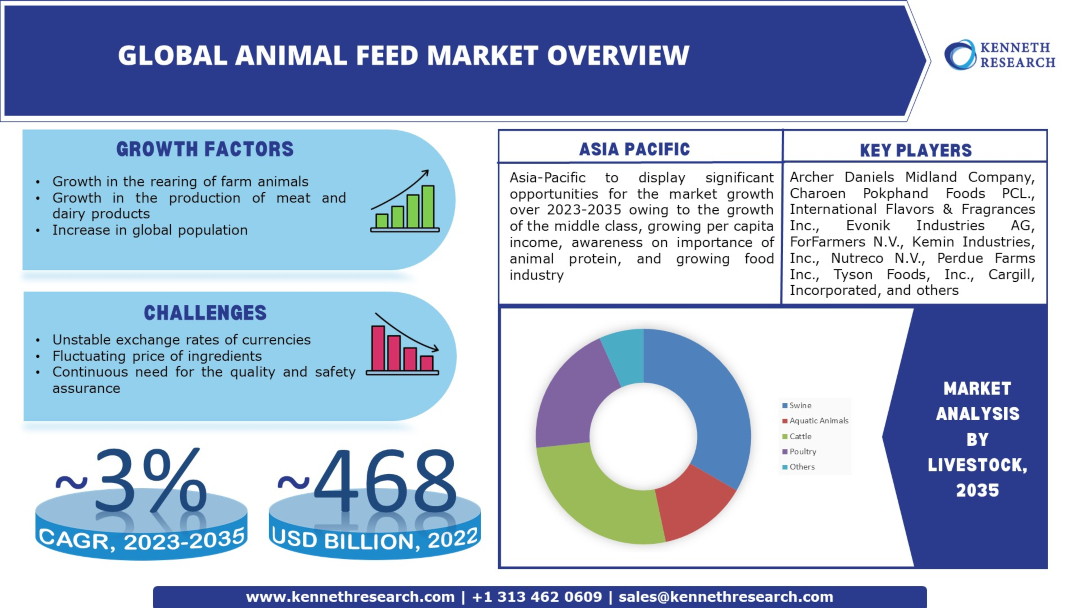

~3% |

|

Base Year Market Size (2022) |

~ USD 468 Billion |

|

Forecast Year Market Size (2035) |

~ USD 632 Billion |

Global Animal Feed Market Highlights Over 2023 - 2035

The global animal feed market is estimated to garner a revenue of ~ USD 632 billion by the end of 2035 by growing at a CAGR of ~3% over the forecast period, i.e., 2023 – 2035. Further, the market generated a revenue of ~ USD 468 billion in the year 2022. The large-scale tending of livestock is the primary factor driving the growth of the global animal feed market. For instance, over 49 billion farm animals are raised for food worldwide every year.

GET A SAMPLE COPY OF THIS REPORT

These animals also represent a significant source of income for several small farmers in developing economies. Though animal feed is the costliest part of rearing farm animals, the global animal feed market size should inevitably grow as the quality of animal feed influences the disease resistance, reproductive capacity, and many other traits of these animals.

Global Animal Feed Market: Growth Drivers and Challenges

Growth Drivers

-

Large-scale Production of Meat and Dairy Products – It is estimated that ~545 million metric tons of cow’s milk and over 21 million metric tons of cheese were produced globally only in 2021. Milk and meat are considered excellent sources of amino acids and protein. Additionally, milk provides calcium, zinc, phosphorous, magnesium, and vitamin B2 and B12, while meat is a good source of iron, vitamin B12, and zinc. A modern feed with carefully selected ingredients is not just a nutritional diet that improves the health of the animals but also a decisive element in improving the quality of end products, including milk, meat, and eggs.

-

Steady Increase in Urban Population – According to the world bank, the urban population has expanded from a 52% in 2011 to a 57% in 2021.

-

Rapid Growth of Global Population – According to the United Nations (U.N.), the world population should reach 9.7 billion in 2050.

-

Considerable Growth in Food Demand – It is estimated that the world should see a demand of over 59% for more food to feed the global population by 2050.

Challenges

-

Exchange Rate Instabilities to Affect the Import and Export of Animal Feed

-

Continuous Need for Safety and Quality Assurance

-

Price Fluctuation of Ingredients Used in Animal Feed

The global animal feed market is segmented and analyzed for demand and supply by livestock into swine, aquatic animals, cattle, poultry, and others. Of these, the swine segment is anticipated to hold the largest market size by the end of 2035. The increasing demand for pork is the main factor driving the segmental growth along with the expansion of the global animal feed market size. The global consumption of pork is projected to reach ~130 million metric tons by 2031.

Global Animal Feed Market Regional Synopsis

Regionally, the global animal feed market is studied into five major regions, including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa region. Amongst these markets, the market in the Asia Pacific region is projected to hold the largest market share by the end of 2035. The expanding middle class, the growth of per capita disposable income, growing health awareness on animal protein consumption, and the development of the food industry in the Asia Pacific are the major factors driving the regional market growth. It is estimated that the appetite for seafood and meat protein in Asia should increase by ~79% by 2050.

Market Segmentation

Our in-depth analysis of the global animal feed market includes the following segments:

|

By Type |

|

|

By Raw Materials |

|

|

By Livestock |

|

|

By Distribution Channel |

|

Key Companies Dominating the Global Animal Feed Market

Our report has covered detailed company profiling comprising company overview, business strategies, key product offerings, financial performance, key performance indicators, risk analysis, recent developments, regional presence, and SWOT analysis among other notable indicators for competitive positioning. Some of the prominent industry leaders in the global animal feed market that are included in our report are Archer Daniels Midland Company, Charoen Pokphand Foods PCL., International Flavors & Fragrances Inc., Evonik Industries AG, ForFarmers N.V., Kemin Industries, Inc., Nutreco N.V., Perdue Farms Inc., Tyson Foods, Inc., Cargill, Incorporated, and others.

Global Animal Feed Market: Latest Developments

-

September, 2022: Evonik Industries AG – announced entering into an agreement with BASF to use Opteinics along with Evonik’s sustainability services and innovative farm management tools to help customers produce more sustainable animal protein and feed, with a reduced environmental footprint.

-

February, 2021: International Flavors & Fragrances Inc. – announced the prospective completion of the merger of IFF with DuPont’s Nutrition & Biosciences (“N&B”) business to redefine their industry and to become a leading provider of solutions and ingredients for their customers from various end-markets.

Key Reasons to Buy Our Report

-

The report covers detailed analysis comprising market share attained by each market segment and its sub-segments.

-

It covers market dynamics including growth drivers, trends, potential opportunities, price trend analysis and challenges that impact the market growth.

-

The report includes detailed company profiles of the major players dominating the market.

-

We use effective research methodologies to calculate the market numbers and provide value-added assessment for overall growth.

-

We provide customized reports as per the clients’ requirement helping them to see possible and unexpected challenges and unforeseen opportunities in order to help them reach their goal.

Geography Analysis:

The report further discusses the market opportunity, compound annual growth rate (CAGR) growth rate, competition, new technology innovations, market players analysis, government guidelines, export and import (EXIM) analysis, historical revenues, future forecasts etc. in the following regions and/or countries:

- North America (U.S. & Canada) Market Size, Y-O-Y Growth, Market Players Analysis & Opportunity Outlook

- Latin America (Brazil, Mexico, Argentina, Rest of Latin America) Market Size, Y-O-Y Growth & Market Players Analysis & Opportunity Outlook

- Europe (U.K., Germany, France, Italy, Spain, Hungary, Belgium, Netherlands & Luxembourg, NORDIC(Finland, Sweden, Norway, Denmark), Ireland, Switzerland, Austria, Poland, Turkey, Russia, Rest of Europe), Poland, Turkey, Russia, Rest of Europe) Market Size, Y-O-Y Growth Market Players Analys & Opportunity Outlook

- Asia-Pacific (China, India, Japan, South Korea, Singapore, Indonesia, Malaysia, Australia, New Zealand, Rest of Asia-Pacific) Market Size, Y-O-Y Growth & Market Players Analysis & Opportunity Outlook

- Middle East and Africa (Israel, GCC (Saudi Arabia, UAE, Bahrain, Kuwait, Qatar, Oman), North Africa, South Africa, Rest of Middle East and Africa) Market Size, Y-O-Y Growth Market Players Analysis & Opportunity Outlook

.

FREQUENTLY ASKED QUESTIONS

Livestock rearing, production of meat and dairy products, increase in global population, increase in urban population, and the growing food demand are the major factors driving the global growth of the animal feed market.

The market is anticipated to attain a CAGR of ~3% over the forecast period, i.e., 2023 – 2035.

Exchange rate instabilities, price fluctuation of ingredients, and concerns regarding quality and safety are the challenges affecting the market growth.

The market in the Asia Pacific region is projected to hold the largest market share by the end of 2035 and provide more business opportunities in the future.

The major players in the market are Archer Daniels Midland Company, Charoen Pokphand Foods PCL., International Flavors & Fragrances Inc., Evonik Industries AG, ForFarmers N.V., and others.

The company profiles are selected based on the revenues generated from the product segment, geographical presence of the company which determine the revenue generating capacity as well as the new products being launched into the market by the company.

The market is segmented by type, raw material, livestock, distribution channel, and by region.

The swine segment is anticipated to garner the largest market size by the end of 2035 and display significant growth opportunities.

Please enter your personal details below

- Archer Daniels Midland Company

- Charoen Pokphand Foods PCL.

- International Flavors & Fragrances Inc.

- Evonik Industries AG

- ForFarmers N.V.

- Kemin Industries Inc.

- Nutreco N.V.

- Perdue Farms Inc.

- Tyson Foods Inc.

- Cargill Incorporated