Asia Pacific Cancer Screening Market Segmentation by Screening Type (Laboratory Tests, Genetic Tests, Imaging, Biopsy, Endoscopy, and Others); by Product (Consumables, and Instruments); by Application (Lung, Breast, Kidney, Colorectal, and Gastric Cancer, Melanoma, and Others); and by End-User (Hospitals & Clinics, Laboratories, and Others)-Demand Analysis & Opportunity Outlook 2020-2030

Report ID: 10352360 |

Published Date: 21 Mar 2025 |

Report Format: |

Delivery Timeline: 48-72 Business Hours

Asia Pacific Cancer Screening Market Highlights Over 2020 - 2030

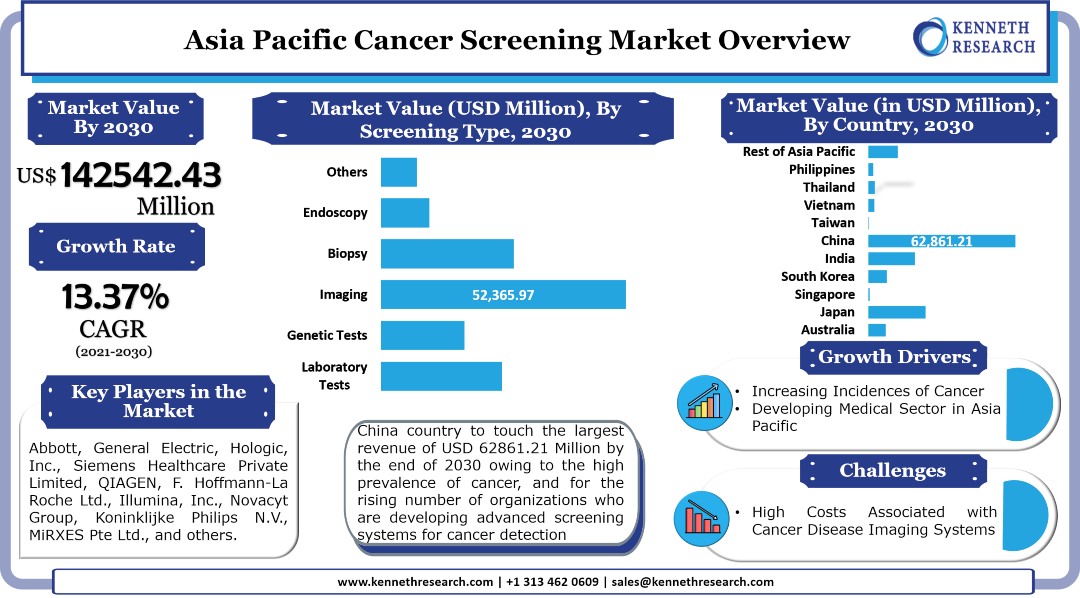

The Asia Pacific cancer screening market is estimated to garner a revenue of USD 142542.43 Million by the end of 2030, by growing at a CAGR of 13.37% over the forecast period, i.e., 2021 – 2030. Moreover, in the year 2020, the market in the region generated a revenue of USD 40982.90 Million. The growth of the market can majorly be attributed to the rising incidences of cancer in the region, which according to the statistics by the World Health Organization (WHO) is anticipated to grow from 9.50 Million in the year 2020 to 15.1 Million in the year 2040. Cancer is one of the leading causes of death, and has taken the lives of 5.81 Million people in the year 2020, according to the WHO. The surge in cancer cases in the region along with the growing concern for the rising number of deaths caused due to the disease, is driving the need for early diagnosis and treatment of the disease, which is anticipated to contribute to the growth of the market in the coming years.

CLICK TO DOWNLOAD SAMPLE REPORT

In addition to this, the growing medical industry in the Asia Pacific, along with the increasing health expenditure in the region is also anticipated to drive the growth of the market in the coming years. According to the statistics by the World Bank, the current health expenditure per capita in the East Asia & Pacific increased from USD 478.291 (in current US$) in the year 2010 to USD 720.909 in the year 2018. Further, the increasing advancements in screening technology, including screening devices and reagents used for testing of the disease, is also projected to create numerous opportunities for the market growth in the coming years.

Asia Pacific Cancer Screening Market Regional Synopsis

By country, the Asia Pacific cancer screening market is segmented into Australia, Japan, Singapore, South Korea, India, China, Taiwan, Vietnam, Thailand, Philippines, and the Rest of Asia Pacific. The market in China is anticipated to garner the largest revenue of USD 62861.21 Million by the end of 2030, up from a revenue of USD 17376.75 Million in the year 2020. The growth of the market in the country can primarily be attributed to the presence of large number of cancer patients, followed by the presence of numerous research organizations who are working tirelessly to develop advanced screening devices for the early diagnosis of the disease. In the other statistics by the WHO, the incidences of cancer in China registered 4.57 Million in the year 2020, and is further projected to reach 6.85 Million by the end of 2040. On the other hand, the market in Japan is projected to generate the second-largest revenue of USD 24374.76 Million by the end of 2030, up from a revenue of USD 6926.11 Million in the year 2020.

Growth Drivers and Challenges Impacting the Growth of the Asia Pacific Cancer Screening Market

Growth Drivers

-

Increasing Incidences of Cancer

-

Developing Medical Sector in Asia Pacific

Challenges

-

High Costs Associated with Cancer Disease Imaging Systems

-

Lack of Skilled Technicians for Performing Screening of the Disease

Asia Pacific Cancer Screening Market Segmentation Synopsis

The Asia Pacific cancer screening market is segmented by screening type into laboratory tests, genetic tests, imaging, biopsy, endoscopy, and others. Out of these, the imaging segment is projected to garner the largest revenue of USD 52365.97 Million by the end of 2030, up from a revenue of USD 15039.41 Million in the year 2020. By product, the market is segmented into consumables, and instruments. Out of these, the consumables segment is projected to garner the largest revenue by the end of 2030 and also grow with the highest CAGR of 13.73% during the forecast period. By application, the market is segmented into lung cancer, breast cancer, melanoma, kidney cancer, colorectal cancer, and others. Out of these, the lung cancer segment is anticipated to generate the second-largest revenue of USD 31055.18 Million by the end of 2030, up from a revenue of USD 8603.68 Million in the year 2020. By end-user, the market is segmented into hospitals & clinics, laboratories, and others. Out of these, the hospitals & clinics segment is anticipated to garner the largest revenue of USD 101732.53 Million by the end of 2030, up from a revenue of USD 28786.12 Million by the end of 2020.

Key Companies Dominating the Market

Our report has covered detailed company profiling comprising company overview, business strategies, key product offerings, financial performance, key performance indicators, risk analysis, recent developments, regional presence, and SWOT analysis among other notable indicators for competitive positioning. Some of the prominent industry leaders in the Asia Pacific cancer screening market that are included in our report are Abbott, General Electric, Hologic, Inc., Siemens Healthcare Private Limited, QIAGEN, F. Hoffmann-La Roche Ltd., Illumina, Inc., Novacyt Group, Koninklijke Philips N.V., MiRXES Pte Ltd., and others.

Latest Developments in the Asia Pacific Cancer Screening Market:

-

May 27th, 2019: Siemens Healthcare Private Limited announced that Apollo Hospital, Chennai (India), has deployed the first digital PET/CT – Biograph Vision device of Siemens. The device, which is first of its kind, would help in delivering the right treatment to the right cancer patient at the right time, and would address cancer progression.

-

July 1st, 2021: QIAGEN announced that it has partnered with Sysmex Corporation of Japan for the commercialization and development of cancer companion diagnostics. The strategic alliance between the two companies will help leverage both the companies for next generation sequencing (NGS) and for the development of drug treatments for cancer.

Key Reasons to Buy Our Report

-

The report covers detailed analysis comprising market share attained by each market segment and its sub-segments.

-

It covers market dynamics including growth drivers, trends, potential opportunities, price trend analysis and challenges that impact the market growth.

-

The report includes detailed company profiles of the major players dominating the market.

-

We use effective research methodologies to calculate the market numbers and provide value-added assessment for overall growth.

-

We provide customized reports as per the clients’ requirement helping them to see possible and unexpected challenges and unforeseen opportunities in order to help them reach their goal.

1. Market Definition

1.1. Definition

1.2.Market Segmentation

2. Assumptions and Acronyms

3. Research Methodology

3.1.Research Process

3.2. Primary Research

3.3. Secondary Research

4. Executive Summary – Asia Pacific Cancer Screening Market

5. Analysis of Market Dynamics

5.1. Market Drivers

5.2. Market Restraints

6. Key Market Opportunities

7. Major Roadblocks for the Market Growth

8. Regulatory Landscape

9. Industry Risk Analysis

10. Pricing Analysis of Cancer Screening Market

11. Value Chain Analysis

12.Analysis on the Major Cancer Screening Tools

13.Industry Growth Outlook

14.Impact of COVID-19 on the Asia Pacific Cancer Screening Market

15. Asia Pacific Cancer Screening Market 2020-2030

15.1. Market Overview

15.2. By Value (USD Million)

15.3. Market Segmentation

15.3.1. By Screening Type

15.3.1.1. Laboratory Tests, 2020-2030F (USD Million)

15.3.1.2. Genetic Tests, 2020-2030F (USD Million)

15.3.1.3. Imaging, 2020-2030F (USD Million)

15.3.1.4. Biopsy, 2020-2030F (USD Million)

15.3.1.5. Endoscopy, 2020-2030F (USD Million)

15.3.1.6. Others, 2020-2030F (USD Million)

15.3.2. By Product

15.3.2.1. Consumables, 2020-2030F (USD Million)

15.3.2.2. Instruments, 2020-2030F (USD Million)

15.3.3. By Application

15.3.3.1. Lung Cancer, 2020-2030F (USD Million)

15.3.3.2. Breast Cancer, 2020-2030F (USD Million)

15.3.3.3. Melanoma, 2020-2030F (USD Million)

15.3.3.4. Kidney Cancer, 2020-2030F (USD Million)

15.3.3.5. Colorectal Cancer, 2020-2030F (USD Million)

15.3.3.6. Gastric Cancer, 2020-2030F (USD Million)

15.3.3.7. Others, 2020-2030F (USD Million)

15.3.4. By End-User

15.3.4.1. Hospitals & Clinics, 2020-2030F (USD Million)

15.3.4.2. Laboratories, 2020-2030F (USD Million)

15.3.4.3. Others, 2020-2030F (USD Million)

15.3.5. By Country

15.3.5.1. Australia, 2020-2030F (USD Million)

15.3.5.2. Japan, 2020-2030F (USD Million)

15.3.5.3. Singapore, 2020-2030F (USD Million)

15.3.5.4. South Korea, 2020-2030F (USD Million)

15.3.5.5. India, 2020-2030F (USD Million)

15.3.5.6. China, 2020-2030F (USD Million)

15.3.5.7. Taiwan, 2020-2030F (USD Million)

15.3.5.8. Vietnam, 2020-2030F (USD Million)

15.3.5.9. Thailand, 2020-2030F (USD Million)

15.3.5.10. Philippines, 2020-2030F (USD Million)

15.3.5.11. Rest of Asia Pacific, 2020-2030F (USD Million)

16.Australia Cancer Screening Market 2020-2030

16.1. Market Overview

16.2. By Value (USD Million)

16.3. Market Segmentation

16.3.1. By Screening Type

16.3.1.1. Laboratory Tests, 2020-2030F (USD Million)

16.3.1.2. Genetic Tests, 2020-2030F (USD Million)

16.3.1.3. Imaging, 2020-2030F (USD Million)

16.3.1.4. Biopsy, 2020-2030F (USD Million)

16.3.1.5. Endoscopy, 2020-2030F (USD Million)

16.3.1.6. Others, 2020-2030F (USD Million)

16.3.2. By Product

16.3.2.1. Consumables, 2020-2030F (USD Million)

16.3.2.2. Instruments, 2020-2030F (USD Million)

16.3.3. By Application

16.3.3.1. Lung Cancer, 2020-2030F (USD Million)

16.3.3.2. Breast Cancer, 2020-2030F (USD Million)

16.3.3.3. Melanoma, 2020-2030F (USD Million)

16.3.3.4. Kidney Cancer, 2020-2030F (USD Million)

16.3.3.5. Colorectal Cancer, 2020-2030F (USD Million)

16.3.3.6. Gastric Cancer, 2020-2030F (USD Million)

16.3.3.7. Others, 2020-2030F (USD Million)

16.3.4. By End-User

16.3.4.1. Hospitals & Clinics, 2020-2030F (USD Million)

16.3.4.2. Laboratories, 2020-2030F (USD Million)

16.3.4.3. Others, 2020-2030F (USD Million)

17. Japan Cancer Screening Market 2020-2030

17.1. Market Overview

17.2. By Value (USD Million)

17.3. Market Segmentation

17.3.1. By Screening Type

17.3.2. By Product

17.3.3. By Application

17.3.4. By End-User

18.Singapore Cancer Screening Market 2020-2030

18.1. Market Overview

18.2. By Value (USD Million)

18.3. Market Segmentation

18.3.1. By Screening Type

18.3.2. By Product

18.3.3. By Application

18.3.4. By End-User

19.South Korea Cancer Screening Market 2020-2030

19.1. Market Overview

19.2. By Value (USD Million)

19.3. Market Segmentation

19.3.1. By Screening Type

19.3.2. By Product

19.3.3. By Application

19.3.4. By End-User

20. India Cancer Screening Market 2020-2030

20.1. Market Overview

20.2. By Value (USD Million)

20.3. Market Segmentation

20.3.1. By Screening Type

20.3.2. By Product

20.3.3. By Application

20.3.4. By End-User

21.China Cancer Screening Market 2020-2030

21.1. Market Overview

21.2. By Value (USD Million)

21.3. Market Segmentation

21.3.1. By Screening Type

21.3.2. By Product

21.3.3. By Application

21.3.4. By End-User

22. Taiwan Cancer Screening Market 2020-2030

22.1. Market Overview

22.2. By Value (USD Million)

22.3. Market Segmentation

22.3.1. By Screening Type

22.3.2. By Product

22.3.3. By Application

22.3.4. By End-User

23. Vietnam Cancer Screening Market 2020-2030

23.1. Market Overview

23.2. By Value (USD Million)

23.3. Market Segmentation

23.3.1. By Screening Type

23.3.2. By Product

23.3.3. By Application

23.3.4. By End-User

24. Thailand Cancer Screening Market 2020-2030

24.1. Market Overview

24.2. By Value (USD Million)

24.3. Market Segmentation

24.3.1. By Screening Type

24.3.2. By Product

24.3.3. By Application

24.3.4. By End-User

25. Philippines Cancer Screening Market 2020-2030

25.1. Market Overview

25.2. By Value (USD Million)

25.3. Market Segmentation

25.3.1. By Screening Type

25.3.2. By Product

25.3.3. By Application

25.3.4. By End-User

26. Rest of Asia Pacific Cancer Screening Market 2020-2030

26.1. Market Overview

26.2. By Value (USD Million)

26.3. Market Segmentation

26.3.1. By Screening Type

26.3.2. By Product

26.3.3. By Application

26.3.4. By End-User

27. Competitive Landscape

27.1. Company Market Share Analysis

27.2. Company Profiles

27.2.1. Abbott

27.2.2. General Electric

27.2.3. Hologic, Inc.

27.2.4. Siemens Healthcare Private Limited

27.2.5. QIAGEN

27.2.6. F. Hoffmann-La Roche Ltd.

27.2.7. Illumina, Inc.

27.2.8. Novacyt Group

27.2.9. Koninklijke Philips N.V.

27.2.10. MiRXES Pte Ltd.

Frequently Asked Question

The market is segmented by screening type, product, application, end-user, and by country.

The imaging segment is projected to garner the largest revenue of USD 52365.97 Million by the end of 2030 and display significant growth opportunities.

Why Choose Kenneth Research ?

-

Insight with Impact : We don’t just gather data — we uncover stories, trends, and opportunities that fuel business growth.

-

Experts Who Get It : Our team speaks your industry’s language and knows what really matters to your customers and market.

-

Custom-Built for You : Forget one-size-fits-all. We craft research and consulting solutions as unique as your business vision.

-

Partners, Not Just Providers : We work with you, not for you — collaborating closely to turn insights into smart, strategic moves.

-

Results That Speak : Our work powers brands, startups, and industry leaders alike — with a track record of ideas that work in the real world.

Report ID: 10352360 |

Published Date: 21 Mar 2025 |

Report Format: |

Delivery Timeline: 48-72 Business Hours

More Reports from Healthcare & Pharmaceuticals Sector

Thank you for contacting us!

""We have received your sample request for the research report. Our research representative will contact you shortly.""

Get a free sample of this report

Asia Pacific Cancer Screening Market

JUMP TO CONTENT