Bentonite Market Analysis by Product Type (Sodium, Calcium, and Others); by Distribution Channel (Direct Company Sales, Distributors & Dealers/Retailers, and Direct Import); by Application (Pet Litter, Foundry Molding Sands, Civil Engineering, Iron Ore Pelletizing, Drilling Fluids, Oil Absorbents, and Others) and by End User (Animal Care, Construction, Oil & Gas, Paper & Pulp, Food & Beverages, Personal Care/Cosmetics and Others)-Global Supply & Demand Analysis & Opportunity Outlook 2010-2026

Report ID: 10352426 |

Published Date: 21 Mar 2025 |

Report Format: |

Delivery Timeline: 48-72 Business Hours

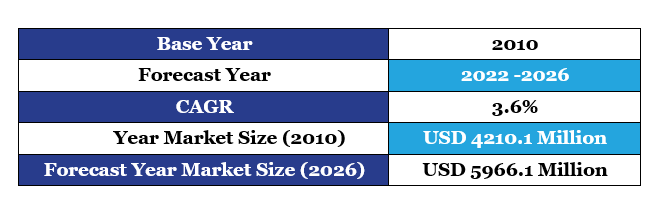

Global Bentonite Market Size, Forecast, and Trend Highlights Over 2010 - 2026

The global bentonite market is estimated to garner a revenue of USD 5966.1 Million by the end of 2026 by growing at a CAGR of 3.6% over the forecast period, i.e., 2022 – 2026. Further, the market generated a revenue of USD 4210.1 Million in the year 2010. Bentonite is used in personal care products namely, beauty face masks, toothpaste, baby powder and others. In 2020, nearly 100 million Americans used baby powder. Therefore, increased usage of personal care products is expected to boost the market growth.

GET A SAMPLE COPY OF THIS REPORT

Rising amount of waste material led to accumulation of the waste in landfills. Sodium bentonite is highly used for the management of waste in landfills. Thus, accumulation of waste is to drive the market growth. Since past decade, waste generation in India has reached around 62 million tonnes each year and out of it about 28% waste is treated, rest of it goes to landfills. Furthermore, increased organic farming and water treatment is also anticipated to augment the growth of bentonite market.

Global Bentonite Market: Growth Drivers and Challenges

Growth Drivers

-

Surge in Architectural and Infrastructural Activities

Construction of building, offices and private homes are incessantly increasing. The rising population and its necessity to build more and more infrastructure for their facilities is leading to the rise of construction. According to the United Nation Department of Economic and Social Affairs, the world’s population is expected to increase more than 1 billion in next 13 years and to grow further to 9.8 billion in 2050.

-

Increased Usage of Bentonite in Toothpaste, Baby Products and Face Masks

Bentonite has an anti- inflammation property and thus highly used in personal care products. Accelerated need of population for the cosmetic products is to boost its market growth. By 2025, around 1300 million people are to become user of personal care products.

-

Growth of Organic Farming

Bentonite is a great adsorbent product, when mixed with limestone, it can absorb up-to 80% of impurities. Expansion of organic farming followed by rising need to purify water by treatment is expected to drive the market growth. The global organic production land amounted to nearly 75 million hectares.

-

Escalation in Awareness of Waste Decomposition

Waste has become a synonym of population. With the increase in population, their needs increase and the waste produce while sufficing those need also increases. In 2018, approximately 147 million tons of municipal solid waste was dumped in landfills.

-

Growth Usage Bentonite in Iron Pellets

Pellet should have high strength and uniform granularity. Bentonite has a strong hygroscopicity, Bentonite has capability of absorbing water by as much as 8-15 times its dry mass. Therefore, it works as an excellent pellet binder, it provides required strength to dry and roasted pellet.

Challenges

-

Restricted Availability of Bentonite

-

Bentonite Causing Harmful Effect on Human, Animal and Plant Health

-

Bentonite high swelling property make it inefficient for preventing hydration

Bentonite imposes serious threats to health, as it contains high percentage of lead, which might attack nervous system, immune system and nephrons. Some variety of bentonite have also founded with some amount of crystalline silica, which is an active carcinogen and likely to attack respiratory system. These health hazardous impact of bentonite is expected to hamper its market growth.

The global bentonite market is segmented and analyzed for demand and supply by end user into animal care, construction, oil & gas, paper & pulp, food & beverages, personal care/cosmetics and others. Among these, the construction segment is anticipated to hold the largest market share by the end of 2026, by registering the largest revenue of USD 3937.6 Million in the same year. The growth of the segment can majorly be attributed to the amazing swelling properties of bentonite, that makes it an essential material for construction purposes. Bentonite swells up-to 100% in just 12 hours and it has liquid limit of about 300%-450%.

Global Bentonite Market Regional Synopsis

Regionally, the global bentonite market is studied into major countries including Germany, India, France, Italy, United Kingdom, Spain, Russia, Netherlands, Turkey, Greece, Belgium, and Others. Amongst these markets, the market in Germany is projected to hold the second-largest market share by the end of 2031 of USD 179.5 Million. In the year 2010, Germany generated a revenue of USD 134.8 Million, and the market for bentonite in the nation is substantially growing owing to increased usage of bentonite slurry in construction areas since, constructional activities are dynamically boosting. In 2021, nearly 2,50,000 building permits were approved for construction in Germany.

Market Segmentation

Our in-depth analysis of the global bentonite market includes the following segments:

|

By Product Type |

|

|

By Distribution Channel |

|

|

By Application |

|

|

By End User |

|

Customize this Report: Request Customization

Key Companies Dominating the Global Bentonite Market

Our report has covered detailed company profiling comprising company overview, business strategies, key product offerings, financial performance, key performance indicators, risk analysis, recent developments, regional presence, and SWOT analysis among other notable indicators for competitive positioning. Some of the prominent industry leaders in the global bentonite market that are included in our report are Imerys S.A., Clariant AG, Minerals Technologies Inc., Stephan Schmidt Group, Bentonit Company Limitied, AromaChimie, Kemira OYJ, ilbe Mineral, Tolsa, Pacific Bentonite Ltd., Black Hills Bentonite, LLC., Wyo-Ben Inc., Ashapura Minechem Limited, Cimbar Performance Minerals and others.

Global Bentonite Market: Latest Developments

-

April, 2021: Cimbar Performance Minerals has announced the acquisition Barite and Alumina Trihydrate manufacturing assets of TOR Minerals International. Inc.,

-

July, 2021: Minerals Technologies, Inc., announces the acquisition of dominating supplier of pet care product company, Normerica, Inc., this acquisition of Normerica is to grow gradually to MTI’s earnings per share in 2021.

Key Reasons to Buy Our Report

-

The report covers detailed analysis comprising market share attained by each market segment and its sub-segments.

-

It covers market dynamics including growth drivers, trends, potential opportunities, price trend analysis and challenges that impact the market growth.

-

The report includes detailed company profiles of the major players dominating the market.

-

We use effective research methodologies to calculate the market numbers and provide value-added assessment for overall growth.

-

We provide customized reports as per the clients’ requirement helping them to see possible and unexpected challenges and unforeseen opportunities in order to help them reach their goal.

Frequently Asked Question

The market is segmented by product type, application, distribution channel, end user, and by country.

The construction is anticipated to garner the largest market size by the end of 2031 and display significant growth opportunities.

Why Choose Kenneth Research ?

-

Insight with Impact : We don’t just gather data — we uncover stories, trends, and opportunities that fuel business growth.

-

Experts Who Get It : Our team speaks your industry’s language and knows what really matters to your customers and market.

-

Custom-Built for You : Forget one-size-fits-all. We craft research and consulting solutions as unique as your business vision.

-

Partners, Not Just Providers : We work with you, not for you — collaborating closely to turn insights into smart, strategic moves.

-

Results That Speak : Our work powers brands, startups, and industry leaders alike — with a track record of ideas that work in the real world.

Report ID: 10352426 |

Published Date: 21 Mar 2025 |

Report Format: |

Delivery Timeline: 48-72 Business Hours

More Reports from Chemicals Sector

Thank you for contacting us!

We have received your sample request for the research report. Our research representative will contact you shortly.

Get Free Sample Report

Bentonite Market

JUMP TO CONTENT