Biofertilizer Market Analysis by Type (Nitrogen Fixing, Phosphate Solubilizers, and Others); by Microorganism (Rhizobium, Azotobacter, Azospirillum, Pseudomonas, Bacillus, VAM, and Others); by Application (Seed Treatment, Soil Treatment, and Others); and by Crop Type (Cereals, Pulses & Oilseeds, Fruits & Vegetables, and Others)-Global Supply & Demand Analysis & Opportunity Outlook 2023-2035

Report ID: 10352508 |

Published Date: 21 Mar 2025 |

Report Format: |

Delivery Timeline: 48-72 Business Hours

Global Biofertilizer Market Scope Report

|

Base Year |

2022 |

|

Forecast Year |

2023-2035 |

|

CAGR |

~14% |

|

Base Year Market Size (2022) |

~ USD 2 Billion |

|

Forecast Year Market Size (2035) |

~ USD 7 Billion |

Global Biofertilizer Market Highlights Over 2023 - 2035

The global biofertilizer market is estimated to garner a revenue of ~USD 7 billion by the end of 2035 by growing at a CAGR of ~14% over the forecast period, i.e., 2023 – 2035. Further, the market generated a revenue of ~USD 2 billion in the year 2022. Growing demand for organic food products, with consumers trying to boost their health and immunity naturally, is the primary factor contributing to the growth of the global biofertilizer market. There was a significant rise in the annual sales of organic food in the United States (U.S.) with the onset of COVID-19, as the sales increased from ~ USD 50 billion in 2019 to ~ USD 57 billion in 2020.

GET A SAMPLE COPY OF THIS REPORT

The growing need for organic food products, combined with prevention of chemical-borne diseases, the inclination towards environmental sustainability, better taste and nutritional value also increases the need for organic food and result in biofertilizer market growth.

Global Biofertilizer Market: Growth Drivers and Challenges

Growth Drivers

-

Environmental Pollution from Chemical Fertilizers – the phosphates and nitrates in chemical fertilizers have been proven to be harmful to water bodies as their presence in the environment results in eutrophication and the formation of hypoxic water. These phenomena deteriorate the quality of waterbodies as the reduced oxygen level in the water makes it unsuitable for the survival of organisms, and the immoderate presence of harmful algal blooms adversely affects the recreational value. In 2021, synthetic N fertilizer was found to be a dangerous climate-polluting industrial chemical as its manufacturing and usage result in ~2% of global emissions.

-

Gradual Expansion of Precision Farming – In 2021, about one-fourth of the farms in the United States (U.S.) were estimated to be leveraging precision agricultural technologies.

-

Expensive Nature of Chemical Fertilizers – the use of chemical fertilizers has been observed to be ~31% more expensive than that of biofertilizers.

-

Worldwide Growth in Food Demand – The global demand for food has been projected to rise by ~40% by 2050.

Challenges

-

Want in the Manufacturing Infrastructure for Biofertilizers

-

Reluctance in the Adoption of Biofertilizers for the Unawareness of Their Benefits

-

High Initial Investment Needed in the Market

The global biofertilizer market is segmented and analyzed for demand and supply by crop type into cereals, pulses & oilseeds, fruits & vegetables, and others. The surge in the need for organically produced fruits and vegetables worldwide following the pandemic is thought to result in the growth of the fruits & vegetable segment in the forecast period. Consumers are becoming more health conscious and aware of the harmful effects of chemical pesticides and fertilizers in the food, leading them to choose healthy organic food over others. This preference for organic food is also facilitated by the increase in per capita income and the purchasing capacities of consumers. It is estimated that of the total produce being sold in the U.S., about 15% is comprised of organic fruits and vegetables.

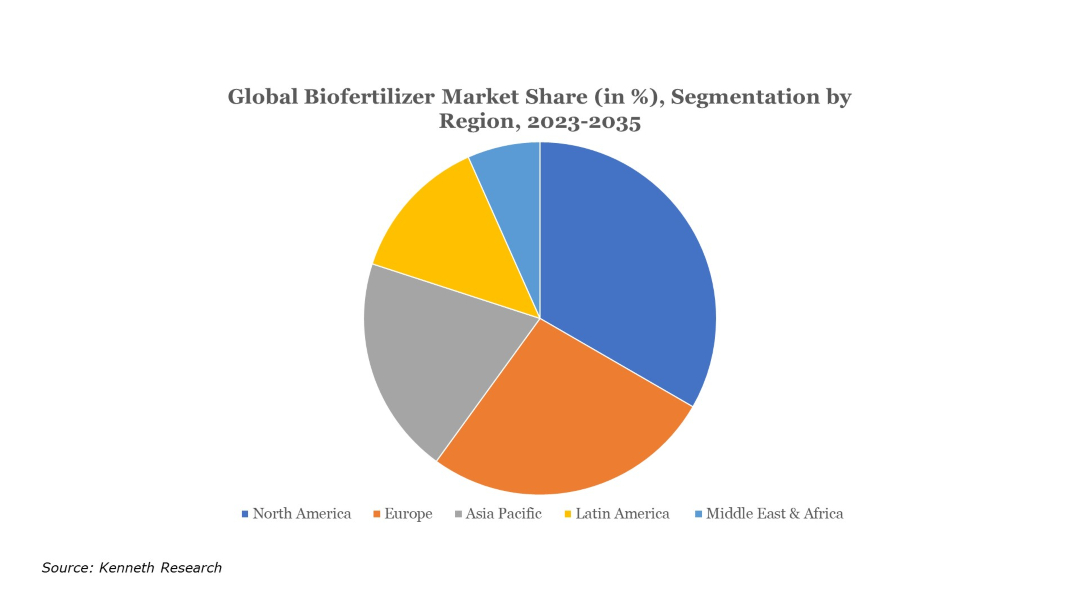

Global Biofertilizer Market Regional Synopsis

Regionally, the global biofertilizer market is studied into five major regions, including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa region. Amongst these markets, the market in the North American region is projected to hold the largest market share by the end of 2035. The biofertilizer market growth in North America should be attributed to the marked shift towards organic food and the increasing organic agriculture in the region. It is estimated that the U.S. alone has more than 4 million acres of organic food farming. Further, the regional market growth is also inspired by the ban on harmful chemicals and fertilizers impacting the environment adversely

Market Segmentation

Our in-depth analysis of the global biofertilizer market includes the following segments:

|

By Type |

|

|

By Microorganism |

|

|

By Application |

|

|

By Crop Type |

|

Key Companies Dominating the Global Biofertilizer Market

Our report has covered detailed company profiling comprising company overview, business strategies, key product offerings, financial performance, key performance indicators, risk analysis, recent developments, regional presence, and SWOT analysis among other notable indicators for competitive positioning. Some of the prominent industry leaders in the global biofertilizer market that are included in our report are Novozymes A/S, Vegalab SA, UPL INDIA LTD, Chr. Hansen Holding A/S, Kiwa Bio-Tech Products Group Corporation, Lallemand Inc, Rizobacter Argentina S.A., T.Stanes & Company Limited., IPL Biologicals Limited, Nutramax Laboratories, Inc., and others.

Global Biofertilizer Market: Latest Developments

-

May, 2021: Rizobacter Argentina S.A. announced the launch of Microstar BIO, a specialty fertilizer product line, which is a combination of biologicals with chemical fertilizers.

-

January, 2021: Lallemand Inc announced the purchase of Biotec BetaGlucans AS (BBG), by their subsidiary Danstar Ferment AG.

Key Reasons to Buy Our Report

-

The report covers detailed analysis comprising market share attained by each market segment and its sub-segments.

-

It covers market dynamics including growth drivers, trends, potential opportunities, price trend analysis and challenges that impact the market growth.

-

The report includes detailed company profiles of the major players dominating the market.

-

We use effective research methodologies to calculate the market numbers and provide value-added assessment for overall growth.

-

We provide customized reports as per the clients’ requirement helping them to see possible and unexpected challenges and unforeseen opportunities in order to help them reach their goal.

Frequently Asked Question

The market is segmented by type, application, microorganism, crop type, and by region.

The fruits & vegetable segment is anticipated to garner the largest market size by the end of 2035 and display significant growth opportunities.

Why Choose Kenneth Research ?

-

Insight with Impact : We don’t just gather data — we uncover stories, trends, and opportunities that fuel business growth.

-

Experts Who Get It : Our team speaks your industry’s language and knows what really matters to your customers and market.

-

Custom-Built for You : Forget one-size-fits-all. We craft research and consulting solutions as unique as your business vision.

-

Partners, Not Just Providers : We work with you, not for you — collaborating closely to turn insights into smart, strategic moves.

-

Results That Speak : Our work powers brands, startups, and industry leaders alike — with a track record of ideas that work in the real world.

Report ID: 10352508 |

Published Date: 21 Mar 2025 |

Report Format: |

Delivery Timeline: 48-72 Business Hours

More Reports from Healthcare & Pharmaceuticals Sector

Thank you for contacting us!

""We have received your sample request for the research report. Our research representative will contact you shortly.""

Get a free sample of this report

Biofertilizer-Market

JUMP TO CONTENT