Crane Market Analysis by Type (Mobile Crane, Fixed Crane, and Marine & Offshore Crane); by Sales (Aftermarket, and New Sales); and by End User Industry (Construction & Infrastructure, Mining, Shipping & Transport, Oil & Gas, Marine & Off Shore, and Others)-Global Supply & Demand Analysis & Opportunity Outlook 2021-2031

Report ID: 10352418 |

Published Date: 21 Mar 2025 |

Report Format: |

Delivery Timeline: 48-72 Business Hours

Global Crane Market Size, Forecast, and Trend Highlights Over 2022 - 2031

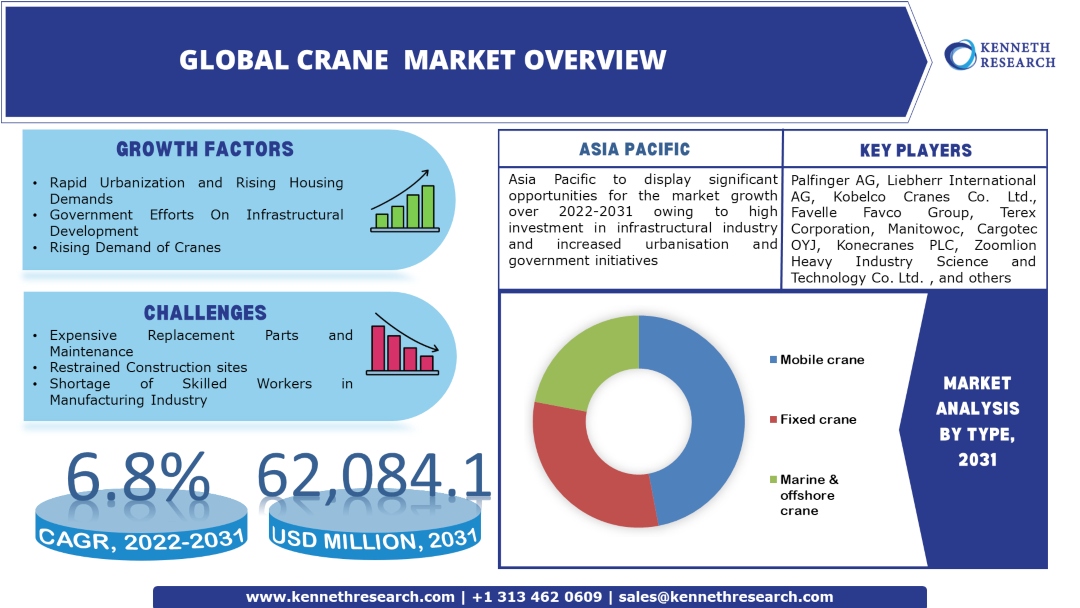

The global crane market is estimated to garner a revenue of USD 62,084.1 Million in the year 2031, by growing at a CAGR of 6.8% over the forecast period, i.e., 2022 – 2031. Further, the market generated a revenue of USD 32,559.4 Million by the end of 2021. With the rising economy, need for better and bigger work places and homes are also increasing, which is leading to more construction. The surge in the number of construction activities worldwide is therefore projected to drive the growth of the market. In 2020, the National Buildings Construction Corporation in India outlined the redesign the government projects worth of around USD 4000 million, and is expected to complete in next 3 years.

GET A SAMPLE COPY OF THIS REPORT

Besides this, with the rising constructional activities, use and demand for cranes is also boosting the growth of the market. About 67% of cranes are stationed at the site of residential and construction projects. Nearly 238 non-residential cranes are being used in projects in the infrastructure, business and health sector.

Global Crane Market: Growth Drivers and Challenges

Growth Drivers

-

Expansion of Construction and Infrastructure Sector

With the rise in population, the need for private and commercial construction is also rising. According to the United Nations, by 2030 world’s population is forecasted to increase by 2 billion people.

-

Government Initiatives for Resident and Commercial Construction

To control the problems of rise in population, pollution and others, government is taking initiatives in funding and constructing commercial infrastructure such as buildings, public transport routes, offices, societies and others. For instance, Regional Rapid Transport System (RRTS) project under the Government of India is spread in the area of around 3500 Km2. In the recent bidding, Afcons Infra won a RRTS contact worth of nearly USD 188 million. Furthermore, European Commission funded project Sofia’s integrated urban transport system. Stage 2 of this project involves, reconstruction of signal tramway track of 3.2 km long, with a 1009 mm rail gauge. This track is likely to host over 7 000 people every day.

-

Rapid Urbanization Leading to Housing Demand

People are rapidly shifting to urban areas which is leading vacant areas into construction site for housing. By 2050, in the developed nations, around 87% of people is likely to be living in urban areas.

-

Rising Need for Automation in Intra-Logistics Business

With the increase in digitization and e-commerce, companies are highly adopting automation for logistics to grow their business which is propelling the demand for cranes. Approximately 61% logistic operators believe the automation of intralogistics is crucial for successful expansion of their business.

-

Rising Demand for all All-Terrain Cranes

With the rise in construction of infra projects, requirement of all-terrain cranes has increased. Mobile crane manufactures are anticipating higher demand of nearly 60 units of 20-60 tons and around 35 units of 80-100 tons in all the terrain category.

Challenges

-

High Repair Expenses and Maintenance Cost of Cranes

-

Lack of Skilled Labor in Manufacturing Industry

-

Restrained Sites and Heavy Load While Serving Onshore Oil and Gas Industry

Replacement parts of cranes are very expensive which makes its repair expenditure costly, Moreover, lack of service centers in Asia-Pacific, Europe, Latin America and other regions makes it maintenance facility challenging.

The global crane market is segmented and analyzed for demand and supply by types into mobile crane, fixed crane, and marine & offshore crane. The mobile cranes segment is anticipated to hold the largest market size by the end of 2031. Rise in global construction, increase in logistics business, and the increased rental demands for equipment is to increase the sales of mobile cranes. In 2021, nearly 8 million units of mobile crane were sold worldwide. Moreover, mobile crane segment collected a revenue of USD 16,464.8 million in 2021. It is expected to garner a revenue of USD 30,158.2 million in the year 2031 and grow at a CAGR of 6.4% over the forecast period.

Global Crane Market Regional Synopsis

Regionally, the global crane market is studied into five major regions including North America, Europe, Asia Pacific, Latin America and Middle East & Africa region. Amongst these markets, the market in Asia Pacific is projected to hold the largest market share by the end of 2031. Asia Pacific market was valued at USD 13186.5 million at the end of 2021. Furthermore, Asia Pacific’s crane market is to grow with the highest CAGR of 7.2% over the forecast period. This growth is attributed to increased demand for housing amongst the rising population. For instance, in India in the low base fiscal year of 2021, housing demand grew by nearly 35% and is further expected to increase by approximately 10%. Furthermore, rapid shift to urbanization is anticipated to boost the market growth. As of 2021, urbanization in India increased around 4% in the last decade. On the account of all the factors, the Asia Pacific crane market is to garner a revenue of USD 26075.3 million at the end of 2031.

The study further incorporates Y-O-Y Growth, market opportunities, demand & supply and forecast future opportunity in North America (United States, Canada, Mexico), South America, Europe (U.K., Germany, France, Italy, Spain, Hungary, BENELUX [Belgium, Netherlands, Luxembourg], NORDIC [Norway, Denmark, Sweden, Finland], Poland, Russia, Rest of Europe), Asia-Pacific (China, India, Japan, South Korea, Malaysia, Indonesia, Taiwan, Hong Kong, Australia, New Zealand, Rest of Asia-Pacific), Middle East and Africa (Israel, GCC [Saudi Arabia, UAE, Bahrain, Kuwait, Qatar, Oman], North Africa, South Africa, Rest of Middle East and Africa).

Market Segmentation

Our in-depth analysis of the global crane market includes the following segments:

|

By Type |

|

|

By Sales |

|

|

By End User Industry |

|

Customize this Report: Request Customization

Key Companies Dominating the Global Crane Market

Our report has covered detailed company profiling comprising company overview, business strategies, key product offerings, financial performance, key performance indicators, risk analysis, recent developments, regional presence, and SWOT analysis among other notable indicators for competitive positioning. Some of the prominent industry leaders in the global crane market that are included in our report are Palfinger AG, Liebherr International AG, Kobelco Cranes Co. Ltd., Favelle Favco Group, Tadano Limited, Terex Corporation, Manitowoc, Cargotec OYJ, Konecranes PLC, Zoomlion Heavy Industry Science and Technology Co. Ltd. and others.

Global Crane Market: Latest Developments

-

February, 2021: Liebherr International AG announced switching to hydrogenated vegetable oil (HVO) to power cranes and machine. It is done to take an approach on reducing up-to 65000 tons of greenhouse gas emission

-

April, 2022: Palfinger AG declared its partnership with Ammann, Prinoth, Rosenbauer and TTControl as part of the Autonomous Operation Cluster (AOC). This cross industry collaboration is commenced to provide advance features based on artificial intelligence to simplify operator’s job and create extra safety.

Key Reasons to Buy Our Report

-

The report covers detailed analysis comprising market share attained by each market segment and its sub-segments.

-

It covers market dynamics including growth drivers, trends, potential opportunities, price trend analysis and challenges that impact the market growth.

-

The report includes detailed company profiles of the major players dominating the market.

-

We use effective research methodologies to calculate the market numbers and provide value-added assessment for overall growth.

-

We provide customized reports as per the clients’ requirement helping them to see possible and unexpected challenges and unforeseen opportunities in order to help them reach their goal.

1. Market Definition

1.1.1. Market Definition

1.1.2. Market Segmentation

2. Assumptions and Acronyms

3. Research Methodology

3.1. Research Process

3.2. Primary Research

3.3. Secondary Research

4. Executive Summary- Global Crane Market

5. Market Dynamics

5.1. Drivers

5.2. Challenges

5.3. Trends

5.4. Opportunities

6. Regulatory and Standards Landscape

7. Industry Risk Analysis

8. Pricing Analysis of Global Crane Market

9. Production Analysis of Cranes (w.r.t. Type and Region)

10. Supply Chain Analysis

11. End User Analysis

12. Competitive Positioning

13. Competitive Landscape

13.1. Market Share Analysis, 2021

13.2. Competitive Benchmarking

14. Global Company Profile

14.1. Konecranes PLC

14.1.1.1. Detailed Overview

14.1.1.2. Assessment of Key Offering

14.1.1.3. Predictive Strategies & Positioning vs Current Positioning

14.1.1.4. Analysis of Growth Strategies

14.1.1.5. Exhaustive Analysis on Key Financial Indicators

14.1.1.6. Recent Developments

14.2. Cargotec OYJ

14.3. Manitowoc

14.4. Terex Corporation

14.5. Tadano Limited

14.6. Kobelco Cranes Co. Ltd

14.7. Palfinger AG

14.8. Liebherr International AG

14.9. Zoomlion Heavy Industry Science and Technology Co. Ltd

14.10. Favelle Favco Group

15. Global Crane Market

15.1. Market Overview

15.2. Market Size (2021–2031)

15.3. Market Segmentation by:

15.3.1. Type

15.3.1.1. Mobile Crane, 2021-2031F (USD million)

15.3.1.1.1. All-Terrain Crane, 2021-2031F (USD million)

15.3.1.1.2. Rough Terrain Crane, 2021-2031F (USD million)

15.3.1.1.3. Crawler Crane, 2021-2031F (USD million)

15.3.1.1.4. Truck Loader Cranes, 2021-2031F (USD million)

15.3.1.1.5. Others, 2021-2031F (USD million)

15.3.1.2. Fixed Crane

15.3.1.2.1. Industrial Crane, 2021-2031F (USD million)

15.3.1.2.2. Tower Crane, 2021-2031F (USD million)

15.3.1.2.3. Others, 2021-2031F (USD million)

15.3.1.3. Marine and Offshore Crane

15.3.1.3.1. Automatic Stacking Crane, 2021-2031F (USD million)

15.3.1.3.2. Mobile Harbor Crane, 2021-2031F (USD million)

15.3.1.3.3. Offshore Crane, 2021-2031F (USD million)

15.3.1.3.4. Rail Mounted Gantry Crane, 2021-2031F (USD million)

15.3.1.3.5. Rubber Mounted Gantry Crane, 2021-2031F (USD million)

15.3.1.3.6. Ship Crane, 2021-2031F (USD million)

15.3.1.3.7. Ship to Shore Gantry Crane, 2021-2031F (USD million)

15.3.1.3.8. Others, 2021-2031F (USD million)

15.3.2. Sale

15.3.2.1. Aftermarket, 2021-2031F (USD million)

15.3.2.2. New Sales, 2021-2031F (USD million)

15.3.3. End-User Industry

15.3.3.1. Construction and Infrastructure, 2021-2031F (USD million)

15.3.3.2. Mining, 2021-2031F (USD million)

15.3.3.3. Shipping and Transport, 2021-2031F (USD million)

15.3.3.4. Oil and Gas, 2021-2031F (USD million)

15.3.3.5. Marine and Off-Shore, 2021-2031F (USD million)

15.3.3.6. Others, 2021-2031F (USD million)

15.3.4. Region

15.3.4.1. North America, 2021-2031F (USD million)

15.3.4.2. Europe, 2021-2031F (USD million)

15.3.4.3. Asia Pacific, 2021-2031F (USD million)

15.3.4.4. Latin America, 2021-2031F (USD million)

15.3.4.5. Middle East and Africa, 2021-2031F (USD million)

16. North America Crane Market

16.1. Market Overview

16.2. Leading Players by Region

16.3. Market Size (2021–2031)

16.4. Market Segmentation by:

16.4.1. Type

16.4.1.1. Mobile Crane, 2021-2031F (USD million)

16.4.1.1.1. All-Terrain Crane, 2021-2031F (USD million)

16.4.1.1.2. Rough Terrain Crane, 2021-2031F (USD million)

16.4.1.1.3. Crawler Crane, 2021-2031F (USD million)

16.4.1.1.4. Truck Loader Cranes, 2021-2031F (USD million)

16.4.1.1.5. Others, 2021-2031F (USD million)

16.4.1.2. Fixed Crane

16.4.1.2.1. Industrial Crane, 2021-2031F (USD million)

16.4.1.2.2. Tower Crane, 2021-2031F (USD million)

16.4.1.2.3. Others, 2021-2031F (USD million)

16.4.1.3. Marine and Offshore Crane

16.4.1.3.1. Automatic Stacking Crane, 2021-2031F (USD million)

16.4.1.3.2. Mobile Harbor Crane, 2021-2031F (USD million)

16.4.1.3.3. Offshore Crane, 2021-2031F (USD million)

16.4.1.3.4. Rail Mounted Gantry Crane, 2021-2031F (USD million)

16.4.1.3.5. Rubber Mounted Gantry Crane, 2021-2031F (USD million)

16.4.1.3.6. Ship Crane, 2021-2031F (USD million)

16.4.1.3.7. Ship to Shore Gantry Crane, 2021-2031F (USD million)

16.4.1.3.8. Others, 2021-2031F (USD million)

16.4.2. Sale

16.4.2.1. Aftermarket, 2021-2031F (USD million)

16.4.2.2. New Sales, 2021-2031F (USD million)

16.4.3. End-User Industry

16.4.3.1. Construction and Infrastructure, 2021-2031F (USD million)

16.4.3.2. Mining, 2021-2031F (USD million)

16.4.3.3. Shipping and Transport, 2021-2031F (USD million)

16.4.3.4. Oil and Gas, 2021-2031F (USD million)

16.4.3.5. Marine and Off-Shore, 2021-2031F (USD million)

16.4.3.6. Others, 2021-2031F (USD million)

16.4.4. Country

16.4.4.1. United States, 2021-2031F (USD million)

16.4.4.2. Canada, 2021-2031F (USD million)

17. Europe Crane Market

17.1. Market Overview

17.2. Leading Players by Region

17.3. Market Size (2021–2031)

17.4. Market Segmentation by:

17.4.1. Type

17.4.2. Sale

17.4.3. End User

17.4.4. Country

17.4.4.1. UK, 2021-2031F (USD million)

17.4.4.2. Germany, 2021-2031F (USD million)

17.4.4.3. Italy, 2021-2031F (USD million)

17.4.4.4. France, 2021-2031F (USD million)

17.4.4.5. Spain, 2021-2031F (USD million)

17.4.4.6. Russia, 2021-2031F (USD million)

17.4.4.7. Netherland, 2021-2031F (USD million)

17.4.4.8. Rest of Europe, 2021-2031F (USD million)

18. Asia Pacific Crane Market

18.1. Market Overview

18.2. Leading Players by Region

18.3. Market Size (2021–2031)

18.4. Market Segmentation by:

18.4.1. Type

18.4.2. Sale

18.4.3. End User

18.4.4. Country

18.4.4.1. China, 2021-2031F (USD million)

18.4.4.2. Australia, 2021-2031F (USD million)

18.4.4.3. Japan, 2021-2031F (USD million)

18.4.4.4. India, 2021-2031F (USD million)

18.4.4.5. Singapore, 2021-2031F (USD million)

18.4.4.6. South Korea, 2021-2031F (USD million)

18.4.4.7. Rest of Asia Pacific, 2021-2031F (USD million)

19. Latin America Crane Market

19.1. Market Overview

19.2. Leading Players by Region

19.3. Market Size (2021–2031)

19.4. Market segmentation by:

19.4.1. Type

19.4.2. Sale

19.4.3. End User

19.4.4. Country

19.4.4.1. Brazil, 2021-2031F (USD million)

19.4.4.2. Argentina, 2021-2031F (USD million)

19.4.4.3. Mexico, 2021-2031F (USD million)

19.4.4.4. Rest of Latin America, 2021-2031F (USD million)

20. Middle East & Africa Crane Market

20.1. Market Overview

20.2. Leading Players by Region

20.3. Market Size (2021–2031)

20.4. Market segmentation by:

20.4.1. Type

20.4.2. Sale

20.4.3. End User

20.4.4. Country

20.4.4.1. GCC, 2021-2031F (USD million)

20.4.4.2. Israel, 2021-2031F (USD million)

20.4.4.3. South Africa, 2021-2031F (USD million)

20.4.4.4. Rest of Middle East and Africa, 2021-2031F (USD million)

Frequently Asked Question

The market is segmented by type, sales, end user industry, and by region.

The mobile crane segment is anticipated to garner the largest market size by collecting aa revenue of USD 30,158.2 by the end of 2031. It is expected to grow at the rate of 6.4% over the forecast period and display significant growth opportunities.

Why Choose Kenneth Research ?

-

Insight with Impact : We don’t just gather data — we uncover stories, trends, and opportunities that fuel business growth.

-

Experts Who Get It : Our team speaks your industry’s language and knows what really matters to your customers and market.

-

Custom-Built for You : Forget one-size-fits-all. We craft research and consulting solutions as unique as your business vision.

-

Partners, Not Just Providers : We work with you, not for you — collaborating closely to turn insights into smart, strategic moves.

-

Results That Speak : Our work powers brands, startups, and industry leaders alike — with a track record of ideas that work in the real world.

Report ID: 10352418 |

Published Date: 21 Mar 2025 |

Report Format: |

Delivery Timeline: 48-72 Business Hours

More Reports from Industrial Automation & Equipment Sector

Thank you for contacting us!

""We have received your sample request for the research report. Our research representative will contact you shortly.""

Get a free sample of this report

Crane Market

JUMP TO CONTENT