Medical Robot Market Analysis by Product and Service (Instrument and Accessories, Services, Robotic Systems, and Consumables); by Application (General Surgery, Neurosurgery, and Others); and by End Users (Hospitals, Ambulatory Surgery Centers and Others)-Global Supply & Demand Analysis & Opportunity Outlook 2023-2033

Report ID: 10009659 |

Published Date: 21 Mar 2025 |

Report Format: |

Delivery Timeline: 48-72 Business Hours

Medical Robot Market Report Scope

|

Base Year |

2022 |

|

Forecast Year |

2023-2033 |

|

CAGR |

~17% |

|

Base Year Market Size (2022) |

~ USD 11 Billion |

|

Forecast Year Market Size (2033) |

~ USD 45 Billion |

Global Medical Robot Market Highlights Over 2023 - 2033

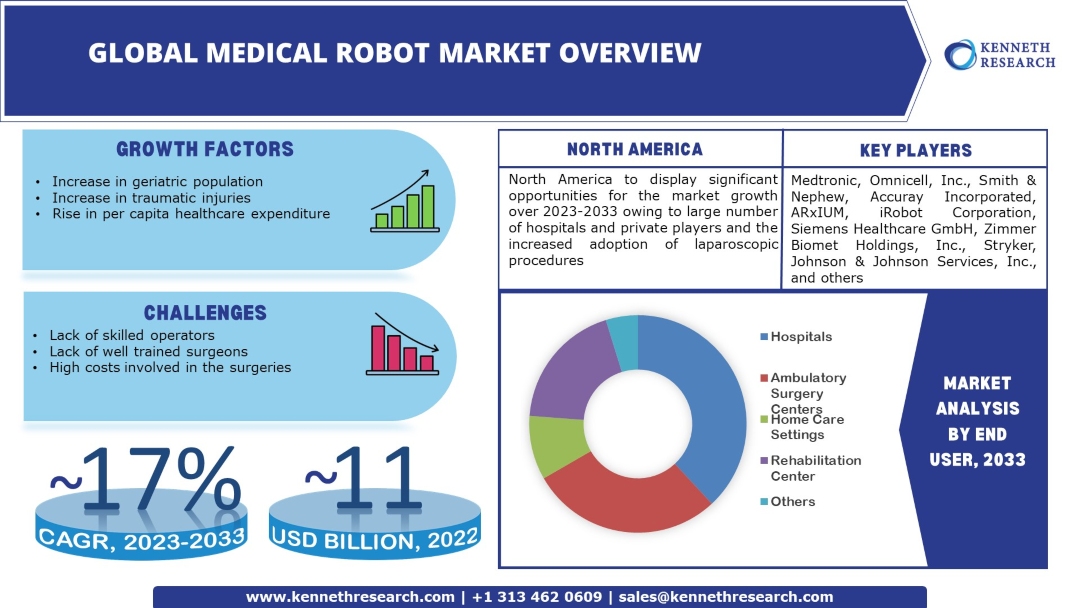

The global medical robot market is estimated to garner a revenue of ~ USD 45 billion by the end of 2033 by growing at a CAGR of ~17% over the forecast period, i.e., 2023 – 2033. Further, the market generated a revenue of ~ USD 11 billion in the year 2022. The steady rise in the geriatric population is the primary factor driving the global medical robot market in the forecast period. For instance, the older population in the world has been projected to reach up to 23% by 2050.

GET A SAMPLE COPY OF THIS REPORT

The cellular and molecular damage that comes with aging results in the decline of mental and physical capacity and increases the risk of diseases and death. The increase in the older population also increases the need for minimally invasive surgery methods for its many benefits, including fewer thrombotic, pulmonary, and abdominal wall complications, reduced blood loss and postoperative pain, and short hospital stay. It also helps in the return to mobility and normal life. Robots are often used to assist surgeons in such surgical processes to enhance the preciseness of the procedure.

Global Medical Robot Market: Growth Drivers and Challenges

Growth Drivers

-

Increasing Percentage of Trauma Injuries – The number of traumatic brain injury (TBI)-related deaths in the United States (U.S.) in 2020 was over 63000. Many more people suffer injuries that are non-fatal and have to visit acute care or emergency department before hospitalization and treatment. People often experience temporary or permanent disabilities and find themselves undergoing mental and physical health care and rehabilitation for a long time. Therapy robots and assistive robots are especially useful in the support and training of motor function and rehabilitation.

-

Rising Preference for Laparoscopic Surgeries – It is estimated that every year more than 12 million laparoscopic surgeries are performed worldwide.

-

Significant Growth in Chronic Diseases or Noncommunicable diseases (NCDs) – It is estimated that deaths following NCDs constitute ~75% of all deaths globally.

-

Increasing Per Capita Health Expenditure – It is expected that healthcare expenditure in the U.S. as a percentage of GDP should increase to over 19% by 2028.

Challenges

-

Lack of Skilled Operators of Medical Robots

-

High Costs of Robot-assisted Surgeries

-

Lack of Specially Trained Surgeons

The global medical robot market is segmented and analyzed for demand and supply by end users into hospitals, ambulatory surgery centers, home care settings, rehabilitation center, and others. Of these, the hospitals’ segment is anticipated to hold the largest market size by the end of 2033. The increasing number of hospitals around the world, the large-scale adoption of medical robots there, the increased number of private players in the segment, and more are the factors driving the growth of the segment. For instance, Japan and Korea, two of the top counties in the number of hospitals worldwide, had more than 8000 and 4000 hospitals, respectively, in 2020.

Global Medical Robot Market Regional Synopsis

Regionally, the global medical robot market is studied into five major regions including North America, Europe, Asia Pacific, Latin America and Middle East & Africa region. Amongst these markets, the market in North American region is projected to hold the largest market share by the end of 2033. The increase in laparoscopic surgeries in the region is the main reason for the growth of the Medical Robot Market in North America. It is estimated that the U.S. alone constitutes ~33% of the whole laparoscopic surgeries performed globally every year. Other reasons resulting in regional market growth include developments in robotics, and growing technological advancements in medicine.

Market Segmentation

Our in-depth analysis of the global medical robot market includes the following segments:

|

By Product and Service |

|

|

By Application |

|

|

By End Users |

|

Customize this Report: Request Customization

Key Companies Dominating the Global Medical Robot Market

Our report has covered detailed company profiling comprising company overview, business strategies, key product offerings, financial performance, key performance indicators, risk analysis, recent developments, regional presence, and SWOT analysis among other notable indicators for competitive positioning. Some of the prominent industry leaders in the global medical robot market that are included in our report are Medtronic, Omnicell, Inc., Smith & Nephew, Accuray Incorporated, ARxIUM, iRobot Corporation, Siemens Healthcare GmbH, Zimmer Biomet Holdings, Inc., Stryker, Johnson & Johnson Services, Inc., and others.

Global Medical Robot Market: Latest Developments

-

July, 2022: Zimmer Biomet Holdings, Inc. – announced collaborating with Hospital for Special Surgery (HSS) through a three-year agreement for creating HSS/Zimmer Biomet Innovation Center for Artificial Intelligence in Robotic Joint Replacement.

-

June, 2021: ARxIUM – announced the installation of the RIVA (ARxIUM) robot by Lille University Hospital thereby becoming the first institution in Europe equipped with a robot for the preparation of injectable chemotherapy.

Key Reasons to Buy Our Report

-

The report covers detailed analysis comprising market share attained by each market segment and its sub-segments.

-

It covers market dynamics including growth drivers, trends, potential opportunities, price trend analysis and challenges that impact the market growth.

-

The report includes detailed company profiles of the major players dominating the market.

-

We use effective research methodologies to calculate the market numbers and provide value-added assessment for overall growth.

-

We provide customized reports as per the clients’ requirement helping them to see possible and unexpected challenges and unforeseen opportunities in order to help them reach their goal.

Frequently Asked Question

The market is segmented by product and service, application, end users and by region.

The hospital segment is anticipated to garner the largest market size by the end of 2033 and display significant growth opportunities.

Why Choose Kenneth Research ?

-

Insight with Impact : We don’t just gather data — we uncover stories, trends, and opportunities that fuel business growth.

-

Experts Who Get It : Our team speaks your industry’s language and knows what really matters to your customers and market.

-

Custom-Built for You : Forget one-size-fits-all. We craft research and consulting solutions as unique as your business vision.

-

Partners, Not Just Providers : We work with you, not for you — collaborating closely to turn insights into smart, strategic moves.

-

Results That Speak : Our work powers brands, startups, and industry leaders alike — with a track record of ideas that work in the real world.

Report ID: 10009659 |

Published Date: 21 Mar 2025 |

Report Format: |

Delivery Timeline: 48-72 Business Hours

More Reports from Healthcare & Pharmaceuticals Sector

Thank you for contacting us!

""We have received your sample request for the research report. Our research representative will contact you shortly.""

Get a free sample of this report

Global Medical Robot

JUMP TO CONTENT