Therapeutic Guidewire Market Analysis by Type (Solid Guidewire, and Wrapped Guidewire); by Shape (J-Shaped, Angled, and Straight); by Application (Neurovascular Diseases, Peripheral Artery Disease, and Others); and by End-User (Hospitals, Academic Institutes, and Clinics)-Global Supply & Demand Analysis & Opportunity Outlook 2022-2031

Report ID: 10042864 |

Published Date: 21 Mar 2025 |

Report Format: |

Delivery Timeline: 48-72 Business Hours

Global Therapeutic Guidewire Market Size, Forecast, and Trend Highlights Over 2022 - 2031

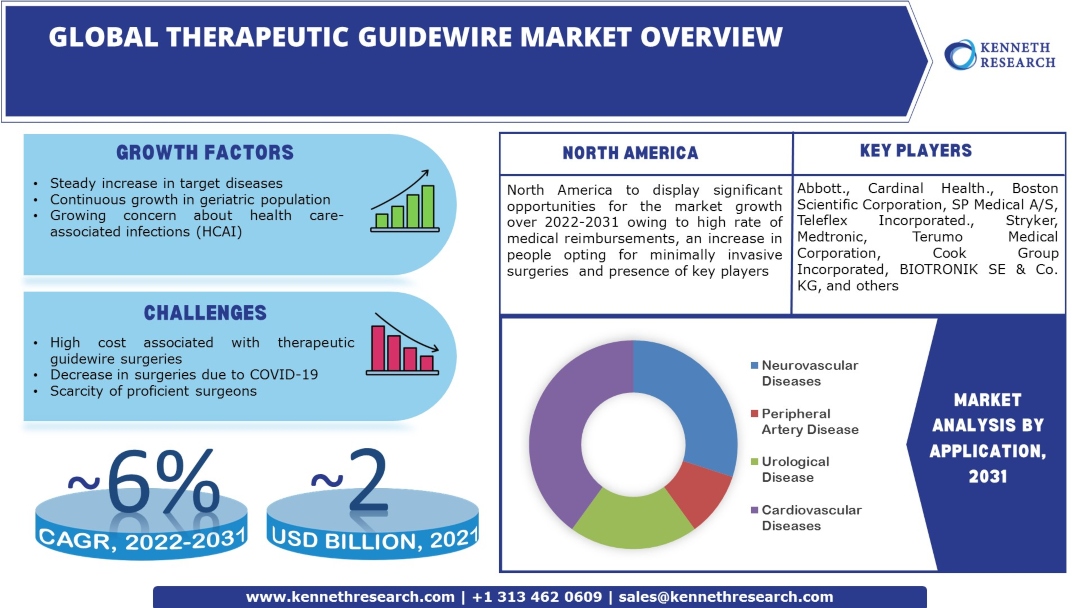

The global therapeutic guidewire market is estimated to garner a revenue of ~USD 4 billion by the end of 2031 by growing at a CAGR of ~6 % over the forecast period, i.e., 2022 – 2031. Further, the market generated a revenue of approximately USD 2 billion in the year 2021. The popular preference for minimally invasive surgery (MIS) is the primary factor boosting the development of the therapeutic guidewire market worldwide. With the surge in minimally invasive surgical procedures, there is an increased demand for the medical devices involved. Since the introduction of laparoscopic surgeries towards the end of the 1980s, the rise in the demand for these surgeries has been exponential. For instance, presently, the number of laparoscopic surgeries performed annually is close to 16 million, and U.S. alone conducts over 30% of the total procedures.

GET A SAMPLE COPY OF THIS REPORT

Despite the decrease in 2020 due to COVID-19, these surgical procedures are expected to show an overall growth of about 2% by 2026. This anticipated growth in surgeries reflects a positive therapeutic guidewire market trend. A therapeutic guidewire is employed in minimally invasive surgeries as it helps to access the desired position by passing through a narrow vascular system. They also control the movement of other equipment inserted into the body, as in the case of a catheter.

Global Therapeutic Guidewire Market: Growth Drivers and Challenges

Growth Drivers

-

Steady Increase in Target Diseases Globally – According to the Centers for Disease Control and Prevention (CDC), the number of new cancer cases reported in the United States in 2019 was 1,752,735. The number of people who died of cancer was 599,589. As per data published by the World Health Organization (WHO), cardiovascular diseases take about 17.9 million lives annually and are the most prominent cause of death globally. Further, the total number of cases of cardiovascular diseases in America in 2019 reflected a growth of about 27% compared to 2010.

-

Continuous Growth in the Geriatric Population Worldwide – The elderly population is more prone to target diseases, and their population growth positively affects the therapeutic guidewire market. The percentage of the elderly population in the world has grown over the past decade from 7.57 % in 2010 to 9.33% in 2020.

-

Growing Concern about Health Care-Associated Infections (HCAI) – It is estimated that in the U.S., about 2 million inpatients acquire HCAIs annually while being treated for other diseases. Government initiatives to control healthcare-associated infections (HCAIs) create new opportunities for the therapeutic guidewire market.

-

Considerable Investment in Research & Development (R&D) in Healthcare – For instance, the United States spends about 6% of its healthcare expenses on research & development. The investments in healthcare R&D facilitate innovations in the use of medical guidewires.

-

Technological Advancement in the Manufacturing of Guidewires – Medical guidewires are available in different materials and shapes and facilitate many applications owing to the advanced technologies employed in their manufacturing. For instance, more than 65% of coronary wires are workhorse guidewires. High Cost Associated with Therapeutic Guidewire Surgeries Decrease in Surgeries Due to COVID-19 Scarcity of Proficient Surgeons

Source: Kenneth Research

Get more information on this report: Request Sample PDF

Market Segmentation

Our in-depth analysis of the global therapeutic guidewire market includes the following segments:

|

By Type |

|

|

By Shape |

|

|

By Application |

|

|

By End Users |

|

Key Companies Dominating the Global Therapeutic Guidewire Market

Our report has covered detailed company profiling comprising company overview, business strategies, key product offerings, financial performance, key performance indicators, risk analysis, recent developments, regional presence, and SWOT analysis among other notable indicators for competitive positioning. Some of the prominent industry leaders in the global therapeutic guidewire market that are included in our report are Abbott., Cardinal Health., Boston Scientific Corporation, SP Medical A/S, Teleflex Incorporated., Stryker, Medtronic, Terumo Medical Corporation, Cook Group Incorporated, BIOTRONIK SE & Co. KG, and others.

Global Therapeutic Guidewire Market: Latest Developments

-

February, 2022: Teleflex Incorporated. - announced the receipt of the U.S. Food and Drug Administration (FDA) clearance for an expanded indication for its coronary guidewires and specialty catheters. These devices used in crossing chronic total occlusion percutaneous coronary interventions (CTO PCI) include Turnpike Catheters, Teleflex GuideLiner V3 Catheter, TrapLiner Catheter, Raider Guidewire, Spectre Guidewire, Bandit Guidewire, R350 Guidewire, and Warrior Guidewire.

-

August, 2021: Abbott. - announced U.S. Food and Drug Administration (FDA) clearance for its optical coherence tomography (OCT) imaging platform. The platform is powered by Ultreon Software, which combines OCT with artificial intelligence (AI). Additionally, it combines with Abbott's PressureWire X guidewire and Dragonfly OpStar imaging catheter to give physicians access to multiple tools to evaluate coronary blockages and blood flow for improved treatment planning for patients. The report covers a detailed analysis comprising market share attained by each market segment and its sub-segments. It covers market dynamics including growth drivers, trends, potential opportunities, price trend analysis, and challenges that impact market growth. The report includes detailed company profiles of the major players dominating the market. We use effective research methodologies to calculate the market numbers and provide value-added assessments for overall growth. We provide customized reports as per the client's requirements helping them to see possible and unexpected challenges and unforeseen opportunities in order to help them reach their goals.

Key Reasons to Buy Our Report

-

The report covers a detailed analysis comprising market share attained by each market segment and its sub-segments.

-

It covers market dynamics including growth drivers, trends, potential opportunities, price trend analysis, and challenges that impact market growth.

-

The report includes detailed company profiles of the major players dominating the market.

-

We use effective research methodologies to calculate the market numbers and provide value-added assessments for overall growth.

-

We provide customized reports as per the clients’ requirement helping them to see possible and unexpected challenges and unforeseen opportunities in order to help them reach their goal.

Frequently Asked Question

The market is segmented by type, shape, application, end-user, and by region.

The cardiovascular diseases segment is anticipated to garner the largest market size by the end of 2031 and display significant growth opportunities.

Why Choose Kenneth Research ?

-

Insight with Impact : We don’t just gather data — we uncover stories, trends, and opportunities that fuel business growth.

-

Experts Who Get It : Our team speaks your industry’s language and knows what really matters to your customers and market.

-

Custom-Built for You : Forget one-size-fits-all. We craft research and consulting solutions as unique as your business vision.

-

Partners, Not Just Providers : We work with you, not for you — collaborating closely to turn insights into smart, strategic moves.

-

Results That Speak : Our work powers brands, startups, and industry leaders alike — with a track record of ideas that work in the real world.

Report ID: 10042864 |

Published Date: 21 Mar 2025 |

Report Format: |

Delivery Timeline: 48-72 Business Hours

More Reports from Healthcare & Pharmaceuticals Sector

Thank you for contacting us!

""We have received your sample request for the research report. Our research representative will contact you shortly.""

Get a free sample of this report

Global Therapeutic Medical Guidewire Market

JUMP TO CONTENT