Industrial Vision Systems Market Analysis by Component (General Machine Vision System and Robotic Cell); by Hardware (Camera, Frame Grabber, and Others); by Product (PC-based Vision System and Smart Cameras-based Vision System); by Application (Quality Assurance & Inspection, Positioning & Guidance, and Others); and by Vertical (Automotive, Consumer Electronics, and Others)-Global Supply & Demand Analysis & Opportunity Outlook 2023-2033

-

Product Code:

RP-ID-10352472 -

Published Date:

28 Oct 2022 -

Region:

Global

-

Category:

Semiconductor & Electronics -

Publisher:

Pub-ID-54

Impact Analysis on the Growth of Market

Inflation and Looming Recession to Haunt Businesses:

In 2022 & 2023, market players expected to sail in rough waters; might incur losses due to huge gap in currency translation followed by contracting revenues, shrinking profit margins & cost pressure on logistics and supply chain. Further, U.S. economy is expected to grow merely by 3% in 2022.

....

The Research Report is Updated with 2022 Base Year, 2023 Estimated year and Forecast till 2035 with Market Insights.

With the dip in global production, the GDP has contracted in 2020 and impacted the market across the world. Upon placing a Sample Request, you will receive an updated report with 2022 as base year, 2023 as estimated year and forecast to 2035. This will have market drivers, recovery rate in the market, insights and competitive analysis.

Market Overview:

Translate Report

Global Industrial Vision Systems Market Scope Report

|

Base Year |

2022 |

|

Forecast Year |

2023-2033 |

|

CAGR |

~9% |

|

Base Year Market Size (2022) |

~ USD 11 Billion |

|

Forecast Year Market Size (2033) |

~ USD 18 Billion |

Global Industrial Vision Systems Market Size, Forecast, and Trend Highlights Over 2023 - 2033

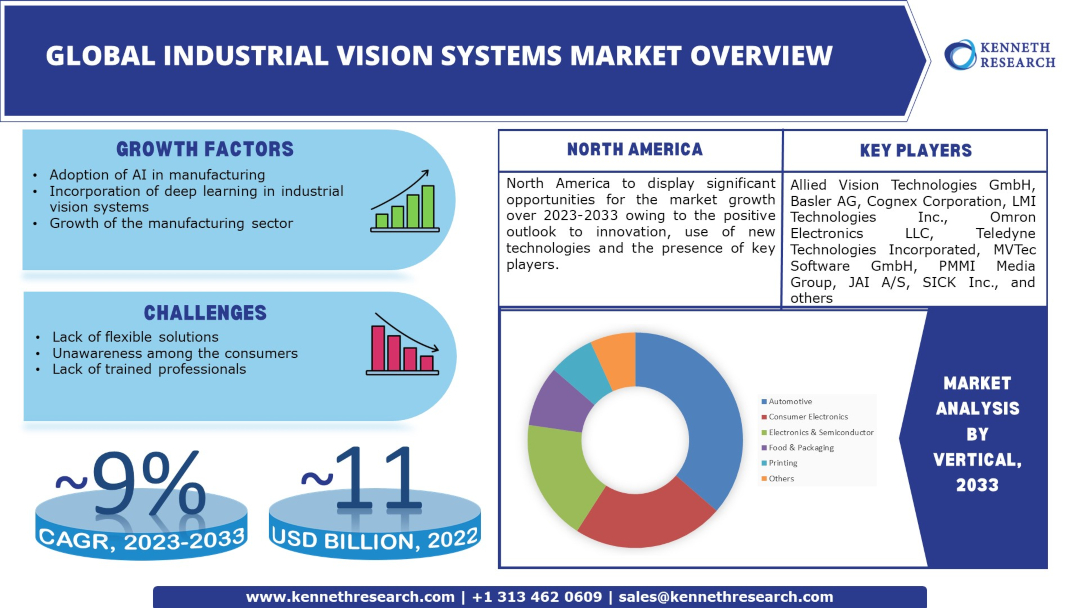

The global industrial vision systems market is estimated to garner a revenue of ~ USD 18 billion by the end of 2033 by growing at a CAGR of ~9% over the forecast period, i.e., 2023 – 2033. Further, the market generated a revenue of ~ USD 11 billion in the year 2022. The large-scale adoption of artificial intelligence (AI) in manufacturing is the primary factor driving the growth of the global industrial vision systems market. It has been observed that ~94% of businesses in manufacturing consider AI as a significant technology for innovation and growth in the sector.

GET A SAMPLE COPY OF THIS REPORT

AI-based solutions, when used in the manufacturing sector, resulting in better productivity by improving machine efficiency and asset utilization while minimizing downtime. AI is also characterized by predictive maintenance to help in quality control Thus, an AI-powered industrial vision/ machine vision system surpasses traditional systems in using two-dimensional (2D) and three-dimensional (3D) data collected from machine vision to analyze products with complex dimensions to effortlessly find and compare varying defects just like a human operator.

Global Industrial Vision Systems Market: Growth Drivers and Challenges

Growth Drivers

-

Efficient Use of the Accuracy of Deep Learning – Deep learning has been used in the medical field to detect lung cancer with an accuracy of up to 95%. In an AI-powered machine vision system, the data collected by AI is then analyzed by deep learning technology. Deep learning works with visual input, just similar to the human brain, and performs tasks like defect identification even in complex imaging conditions with the robustness and promptness of a computerized system.

-

Growth of the Manufacturing Sector – It is estimated that manufacturing contributed up to 11% of the total GDP of the United States (U.S.) in 2020.

-

Undeniable Benefits of Industrial Automation – Automation in key industries, including manufacturing, is believed to contribute ~USD 16 trillion to the world economy by 2030.

-

Immense Use of Industrial Robots – It is estimated that as of 2022, around the world, about 3 million industrial robots are at work.

Challenges

-

Lack of Flexible Solutions in Industrial Vision

-

Lack of Familiarity Among the Consumers About the Evolving Technologies in Industrial Vision

-

Lack of Highly Trained Professionals to Run the Industrial Vision System

The global industrial vision systems market is segmented and analyzed for demand and supply by vertical into automotive, consumer electronics, electronics and semiconductors, food & packaging and printing, and others. Of these, the automotive segment is anticipated to hold the largest market size by the end of 2033. In the global industrial vision systems market, the automotive industry has been observed to hold the largest market share, which amounts to ~16%. The efficient use of industrial vision/machine vision in robotic assistance and inspection processes is the primary factor driving the segmental growth

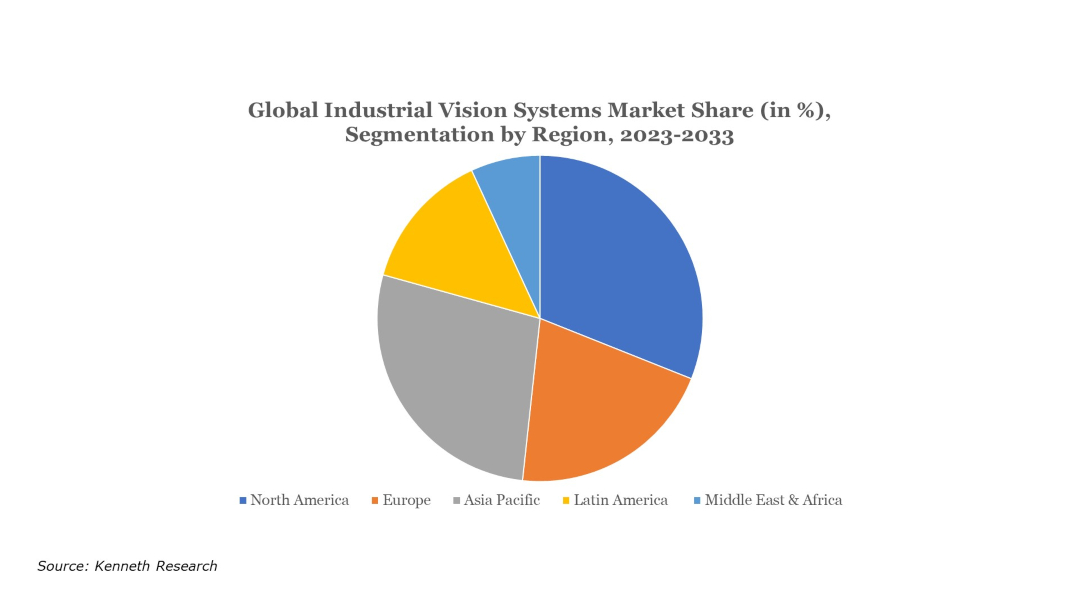

Global Industrial Vision Systems Market Regional Synopsis

Regionally, the global industrial vision systems market is studied into five major regions, including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa region. Amongst these markets, the market in the North American region is projected to hold the largest market share by the end of 2033. The regional market growth is mainly motivated by the ideal outlook toward innovation, the presence of key players, and the use of advanced technologies in different industries. It was estimated in 2019 that the U.S. was one of the top three most innovative countries in the world.

Market Segmentation

Our in-depth analysis of the global industrial vision systems market includes the following segments:

|

By Component |

|

|

By Hardware |

|

|

By Product |

|

|

By Application |

|

|

By Vertical |

|

Key Companies Dominating the Global Industrial Vision Systems Market

Our report has covered detailed company profiling comprising company overview, business strategies, key product offerings, financial performance, key performance indicators, risk analysis, recent developments, regional presence, and SWOT analysis among other notable indicators for competitive positioning. Some of the prominent industry leaders in the global industrial vision systems market that are included in our report are Allied Vision Technologies GmbH, Basler AG, Cognex Corporation, LMI Technologies Inc., Omron Electronics LLC, Teledyne Technologies Incorporated, MVTec Software GmbH, PMMI Media Group, JAI A/S, SICK Inc., and others.

Global Industrial Vision Systems Market: Latest Developments

-

September, 2022: MVTec Software GmbH announced the launch of its new machine vision software, HALCON 22.11 which combines traditional methods of machine vision with deep learning.

-

August, 2022: LMI Technologies Inc. announced the release of its new series of 4K+ resolution smart 3D laser line profile sensors, the Gocator 2600 Series, capable of the inspection process and 3D scanning in different sectors.

Key Reasons to Buy Our Report

-

The report covers detailed analysis comprising market share attained by each market segment and its sub-segments.

-

It covers market dynamics including growth drivers, trends, potential opportunities, price trend analysis and challenges that impact the market growth.

-

The report includes detailed company profiles of the major players dominating the market.

-

We use effective research methodologies to calculate the market numbers and provide value-added assessment for overall growth.

-

We provide customized reports as per the clients’ requirement helping them to see possible and unexpected challenges and unforeseen opportunities in order to help them reach their goal.

Geography Analysis:

The report further discusses the market opportunity, compound annual growth rate (CAGR) growth rate, competition, new technology innovations, market players analysis, government guidelines, export and import (EXIM) analysis, historical revenues, future forecasts etc. in the following regions and/or countries:

- North America (U.S. & Canada) Market Size, Y-O-Y Growth, Market Players Analysis & Opportunity Outlook

- Latin America (Brazil, Mexico, Argentina, Rest of Latin America) Market Size, Y-O-Y Growth & Market Players Analysis & Opportunity Outlook

- Europe (U.K., Germany, France, Italy, Spain, Hungary, Belgium, Netherlands & Luxembourg, NORDIC(Finland, Sweden, Norway, Denmark), Ireland, Switzerland, Austria, Poland, Turkey, Russia, Rest of Europe), Poland, Turkey, Russia, Rest of Europe) Market Size, Y-O-Y Growth Market Players Analys & Opportunity Outlook

- Asia-Pacific (China, India, Japan, South Korea, Singapore, Indonesia, Malaysia, Australia, New Zealand, Rest of Asia-Pacific) Market Size, Y-O-Y Growth & Market Players Analysis & Opportunity Outlook

- Middle East and Africa (Israel, GCC (Saudi Arabia, UAE, Bahrain, Kuwait, Qatar, Oman), North Africa, South Africa, Rest of Middle East and Africa) Market Size, Y-O-Y Growth Market Players Analysis & Opportunity Outlook

.

FREQUENTLY ASKED QUESTIONS

The growth of the manufacturing sector along with the adoption of AI, deep learning, automation, and industrial robots are the major factors driving the growth of the global industrial vision systems market.

The market is anticipated to attain a CAGR of ~9% over the forecast period, i.e., 2023 – 2033.

Lack of flexible solutions, lack of trained professionals, and unawareness among consumers are the challenges affecting the market growth.

The market in the North American region is projected to hold the largest market share by the end of 2033 and provide more business opportunities in the future.

The major players in the market are Allied Vision Technologies GmbH, Basler AG, Cognex Corporation, LMI Technologies Inc., Omron Electronics LLC, and others.

The company profiles are selected based on the revenues generated from the product segment, geographical presence of the company which determine the revenue generating capacity as well as the new products being launched into the market by the company.

The market is segmented by component, hardware, product, application, vertical, and by region.

The automotive segment is anticipated to garner the largest market size by the end of 2033 and display significant growth opportunities.

Please enter your personal details below

- Allied Vision Technologies GmbH

- Basler AG

- Cognex Corporation

- LMI Technologies Inc.

- Omron Electronics LLC