North America, Europe, and APAC Scrap Metal Recycling Market Segmentation by Type (Ferrous, and Non-Ferrous); by Scrap Type (Old, and New Scrap); by Instrument (Shredder & Balers, Shearing, Granulation, and Briquetting Machine); and by Industries (Building & Construction, Automotive, Industrial Manufacturing, Electricals, Shipbuilding, Consumer Electronics, and Others)-Demand Analysis & Opportunity Outlook 2021-2031

Report ID: 10352384 |

Published Date: 21 Mar 2025 |

Report Format: |

Delivery Timeline: 48-72 Business Hours

North America, Europe, and APAC Scrap Metal Recycling Market Highlights Over 2021 - 2031

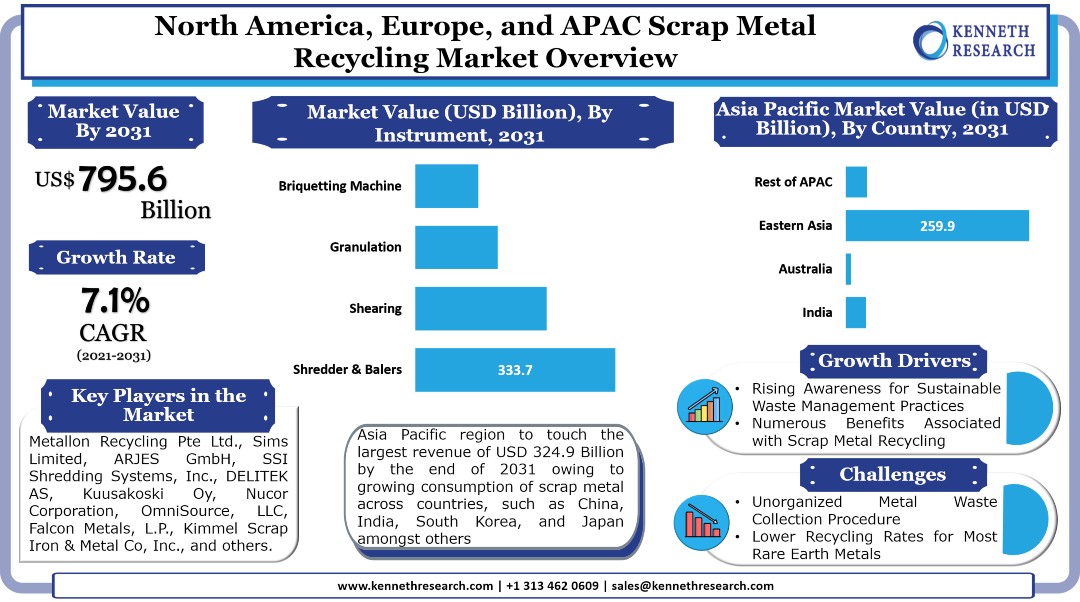

The North America, Europe, and APAC scrap metal recycling market is estimated to garner a revenue of USD 795.6 Billion by the end of 2031, by growing at a CAGR of 7.1% over the forecast period, i.e., 2021 – 2031. Moreover, in the year 2021, the market registered a revenue of USD 404.8 Billion. The growth of the market can be attributed to increasing awareness programs for sustainable waste management practices in these nations, backed by the rising concern for the increasing quantity of solid wastes generated from scrap metals by different types of industries. Besides this, the growing awareness for solid waste management (SWM) among companies, growing stringent norms to reduce environmental pollution, along with the increasing number of initiatives to promote sustainable waste management practices are some of the major factors anticipated to drive the market growth.

CLICK TO DOWNLOAD A SAMPLE REPORT

The growth of the market can also be attributed to the numerous benefits associated with recycling of metals, as the recycling process helps in saving up to 20 times the energy required when compared to the mining of these metals from ores. Additionally, the production of metals using secondary raw materials also helps to lower carbon dioxide emissions. In addition to this, the increasing production and consumption of scrap metal is also projected to add in the growth of the market in the coming years. According to the statistics by the Bureau of International Recycling (BIR), China registered to have the largest consumption of scrap steel in the year 2019 with a consumption volume of 215.93 Million Tonnes. This was an increase from 187.77 Million Tonnes in the year 2018.

North America, Europe, and APAC Scrap Metal Recycling Market Regional Synopsis

North America, Europe, and APAC scrap metal recycling market is segmented by region into North America, Europe, and the Asia Pacific. The market in the Asia Pacific is anticipated to garner the largest revenue of USD 324.9 Billion by the end of 2031, up from a revenue of USD 171.8 Billion in the year 2021. The growth of the market in the region can primarily be attributed to the growing consumption of scrap metal across countries, such as China, India, South Korea, and Japan amongst others, followed by the increasing favorable government policies that promote recycling of metal wastes. One another significant factor anticipated to drive the growth of the market in the region is the rising consumption of Electrical and Electronic Equipment (EEE), backed by the presence of the most populated countries in the world, i.e., China and India as well as the growing disposable income. Moreover, with the growing consumption of EEE, the amount of e-waste generated is also increasing massively in the region. According to the statistics by the United Nations Institute for Training and Research, Asia generated the largest volume of e-waste of 24.9 Mt in the year 2019.

The scrap metal recycling market in the Asia Pacific is further segmented by country into India, Australia, Eastern Asia, and Rest of APAC. The market in Eastern Asia is expected to garner the largest revenue of USD 259.9 Billion by the end of 2031, up from a revenue of USD 135.9 Billion in the year 2021. On the other hand, the market in India is expected to grow with the highest CAGR of 7.7% during the forecast period.

Growth Drivers and Challenges Impacting the Growth of the North America, Europe, and APAC Scrap Metal Recycling Market

Growth Drivers

-

Increasing Awareness Programs for Sustainable Waste Management Practices

-

Numerous Benefits Associated with Scrap Metal Recycling

Challenges

-

Unorganized Metal Waste Collection Procedure

-

Lower Recycling Rates for Most Rare Earth Metals

North America, Europe, and APAC Scrap Metal Recycling Market Segmentation Synopsis

The North America, Europe, and APAC scrap metal recycling market is segmented by type into ferrous metal, and non-ferrous metal. Out of these, the ferrous metal segment is anticipated to garner the largest revenue by the end of 2031 and also grow with the highest CAGR of 7.3% during the forecast period. By scrap type, the market is segmented into old scrap and new scrap, out of which, the old scrap segment is projected to garner the highest market share by the end of 2031. By instrument, the market is segmented into shredder & balers, shearing, granulation, and briquetting machine. Out of these, the shredder & balers segment is anticipated to garner the largest revenue of USD 333.7 Billion by the end of 2031, up from a revenue of USD 174.7 Billion in the year 2021. By industries, the market is segmented into building & construction, automotive, industrial manufacturing, electricals, shipbuilding, consumer electronics, and others. Out of these, the building & construction segment is anticipated to garner the largest revenue of USD 216.7 Billion by the end of 2031, up from a revenue of USD 111.4 Billion in the year 2021.

Key Companies Dominating the Market

Our report has covered detailed company profiling comprising company overview, business strategies, key product offerings, financial performance, key performance indicators, risk analysis, recent developments, regional presence, and SWOT analysis among other notable indicators for competitive positioning. Some of the prominent industry leaders in the North America, Europe, and APAC scrap metal recycling market that are included in our report are Metallon Recycling Pte Ltd., Sims Limited, ARJES GmbH, SSI Shredding Systems, Inc., DELITEK AS, Kuusakoski Oy, Nucor Corporation, OmniSource, LLC, Falcon Metals, L.P., Kimmel Scrap Iron & Metal Co, Inc., American Iron & Metal (AIM), Aurubis AG, DBW Metals Recycling, Hanwa Co., Ltd., KYOEI STEEL Ltd., Yoshikawa Kogyo Co., Ltd., OSAKA Titanium Technologies Co., Ltd., NIKKEI MC ALUMINIUM CO., LTD., and others.

Latest Developments in the North America, Europe, and APAC Scrap Metal Recycling Market:

-

May 31st, 2018: ARJES GmbH announced that it has partnered with Bandit Industries Inc. to market its recycling equipment in North America, South America, and other markets.

-

October 1st, 2021: Nucor Corporation announced that it has made two acquisitions on behalf of its subsidiary, The David J. Joseph Company (DJJ). The first acquisition included the purchase of Grossman Iron and Steel, based out of St. Louis, Missouri, by Advantage Metals Recycling (AMR), the wholly owned company of DJJ, on September 30th, 2021. Further, the second acquisition was scheduled for closure of transaction on October 4th, 2021, by Trademark Metals Recycling LLC (TMR), another wholly owned company of DJJ, of Garden Street Iron & Metal Inc., based out of Fort Myers, Florida. Both these acquisitions would represent a 10% growth in recycling capacity of Nucor.

Key Reasons to Buy Our Report

-

The report covers detailed analysis comprising market share attained by each market segment and its sub-segments.

-

It covers market dynamics including growth drivers, trends, potential opportunities, price trend analysis and challenges that impact the market growth.

-

The report includes detailed company profiles of the major players dominating the market.

-

We use effective research methodologies to calculate the market numbers and provide value-added assessment for overall growth.

-

We provide customized reports as per the clients’ requirement helping them to see possible and unexpected challenges and unforeseen opportunities in order to help them reach their goal.

Frequently Asked Question

The market is segmented by type, scrap type, instrument, industries, and by region.

The shredder & balers segment is anticipated to garner the largest revenue of USD 333.7 Billion by the end of 2031 and display significant growth opportunities.

Why Choose Kenneth Research ?

-

Insight with Impact : We don’t just gather data — we uncover stories, trends, and opportunities that fuel business growth.

-

Experts Who Get It : Our team speaks your industry’s language and knows what really matters to your customers and market.

-

Custom-Built for You : Forget one-size-fits-all. We craft research and consulting solutions as unique as your business vision.

-

Partners, Not Just Providers : We work with you, not for you — collaborating closely to turn insights into smart, strategic moves.

-

Results That Speak : Our work powers brands, startups, and industry leaders alike — with a track record of ideas that work in the real world.

Report ID: 10352384 |

Published Date: 21 Mar 2025 |

Report Format: |

Delivery Timeline: 48-72 Business Hours

More Reports from ICT & Telecom Sector

Thank you for contacting us!

""We have received your sample request for the research report. Our research representative will contact you shortly.""

Get a free sample of this report

North America, Europe, and APAC Scrap Metal Recycling Market

JUMP TO CONTENT