Oncology Drugs Market Analysis by Drug Class (Chemotherapy, Targeted Therapy, Immunotherapy, Hormonal Therapy); and by Indication (Lung Cancer, Stomach Cancer, Colorectal Cancer, Breast Cancer, Prostate Cancer, Liver Cancer, Esophagus Cancer, Cervical Cancer, Kidney Cancer, Bladder Cancer, Other Cancers)-Global Supply & Demand Analysis & Opportunity Outlook 2023-2035

Report ID: 10352519 |

Published Date: 21 Mar 2025 |

Report Format: |

Delivery Timeline: 48-72 Business Hours

Global Oncology Drugs Market Scope Report

|

Base Year |

2022 |

|

Forecast Year |

2023-2035 |

|

CAGR |

~8% |

|

Base Year Market Size (2022) |

~ USD 148 Billion |

|

Forecast Year Market Size (2035) |

~ USD 289 Billion |

Global Oncology Drugs Market Highlights Over 2023 - 2035

The global oncology drugs market is estimated to garner a revenue of ~USD 289 billion by the end of 2035 by growing at a CAGR of ~8% over the forecast period, i.e., 2023 – 2035. Further, the market generated a revenue of ~USD 148 billion in the year 2022. The growing prevalence of cancer requiring immediate attention for the harm it can do to vital organs and the overall body functioning is the primary reason for the growth of the global oncology drugs market. Cancer prevails to be one of the leading causes of death worldwide, and only in 2020, the number of cancer-related deaths amounted to ~11 million.

GET A SAMPLE COPY OF THIS REPORT

Many risk factors contribute to the incidence of cancer, including alcohol consumption, tobacco use, physical inactivity, unhealthy diet, and air pollution. Thus, the prevalence of these factors leads to the ubiquity of cancer, and the growth of the global oncology drugs market.

Global Oncology Drugs Market: Growth Drivers and Challenges

Growth Drivers

-

Alarming Presence of Cancer-Causing Infections – The presence of certain cancer-causing infections also contributes to the significant occurrences of cancer. According to the World Health Organization (WHO), infections, including hepatitis and human papillomavirus (HPV), are the leading causes for ~30% of cancer cases in countries belonging to the low-and lower-middle-income categories. Globally, between 14% and 21% of cancer is thought to be related to infections of various kinds. Further, some infections suppress the body’s immune system, which is supposed to protect the body from cancer.

-

Growing Geriatric Population with Cancer – The number of cancer cases diagnosed and the cancer deaths among the elderly population in the United States (U.S.) were ~140691 and ~103251 respectively.

-

Considerable Spending in Oncology – The total oncology spending in the world, including that for supportive care in 2021, amounted to about USD 188 billion.

-

Significant Number of Oncology Clinical Trials – It is estimated that ~1490 trials of investigational drugs in targeting cancer were completed in 2021.

Challenges

-

High Costs Required for Drug Development

-

Cancer Drug Therapies Causing Adverse Effects

-

Drug Resistance of Cancer Stem Cells, Making Drugs Ineffective

The global oncology drugs market is segmented and analyzed for demand and supply by indication into lung cancer, stomach cancer, colorectal cancer, breast cancer, prostate cancer, liver cancer, esophagus cancer, cervical cancer, kidney cancer, bladder cancer, and others. The breast cancer segment is expected to show the most significant market growth in the forecast period as a result of the wide prevalence of the type of cancer and the access to screening facilities. For instance, from 2015 to the end of 2020, about 8 million women alive were diagnosed with breast cancer, which was then recognized as the most prevalent cancer in the world.

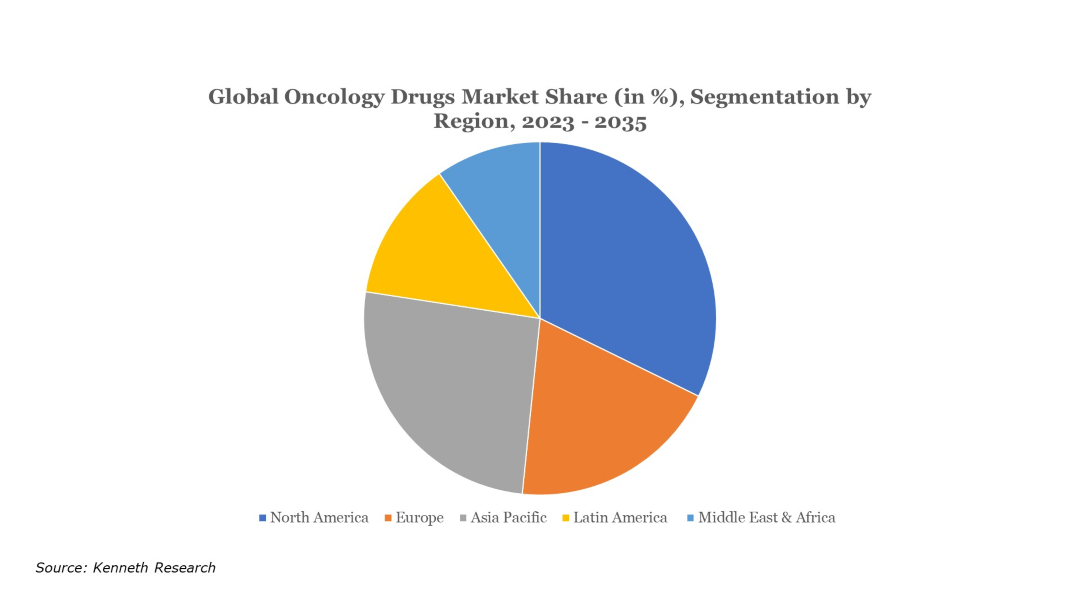

Global Oncology Drugs Market Regional Synopsis

Regionally, the global oncology drugs market is studied into five major regions, including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa region. Amongst these markets, the market in the North American region is projected to hold the largest market share by the end of 2035. The regional market growth is thought to be fueled by reasons such as the presence of key players, large patient population, developed infrastructure in healthcare, ease in drug availability, progress in research, development, and innovation, and favorable reimbursement policies for treatment. Only in the U.S., the estimated number of new cases of cancer and deaths related to cancer are ~2 million and ~609, 361 respectively.

Market Segmentation

Our in-depth analysis of the global oncology drugs market includes the following segments:

|

By Drug Class |

|

|

By Indication |

|

Key Companies Dominating the Global Oncology Drugs Market

Our report has covered detailed company profiling comprising company overview, business strategies, key product offerings, financial performance, key performance indicators, risk analysis, recent developments, regional presence, and SWOT analysis among other notable indicators for competitive positioning. Some of the prominent industry leaders in the global oncology drugs market that are included in our report are AbbVie Inc., Astellas Pharma Inc., AstraZeneca PLC, Bristol Myers Squibb Company, F. Hoffmann-La Roche Ltd, Johnson & Johnson Services, Inc., Merck & Co., Inc., Novartis Pharmaceuticals Corporation, Pfizer Inc., GlaxoSmithKline plc, and others.

Global Oncology Drugs Market: Latest Developments

-

July, 2022: GlaxoSmithKline plc announced completing the acquisition of Sierra Oncology, Inc., a biopharmaceutical company based in California to develop the strength of its portfolio of specialty medicines and vaccines.

-

November, 2021: Pfizer Inc. announced the completion of acquiring, Trillium Therapeutics, an immuno-oncology business, noted for its innovative therapeutics in cancer treatment.

Key Reasons to Buy Our Report

-

The report covers detailed analysis comprising market share attained by each market segment and its sub-segments.

-

It covers market dynamics including growth drivers, trends, potential opportunities, price trend analysis and challenges that impact the market growth.

-

The report includes detailed company profiles of the major players dominating the market.

-

We use effective research methodologies to calculate the market numbers and provide value-added assessment for overall growth.

-

We provide customized reports as per the clients’ requirement helping them to see possible and unexpected challenges and unforeseen opportunities in order to help them reach their goal.

Frequently Asked Question

The market is segmented by drug class, indication, and by region.

The breast cancer segment is anticipated to garner the largest market size by the end of 2035 and display significant growth opportunities.

Why Choose Kenneth Research ?

-

Insight with Impact : We don’t just gather data — we uncover stories, trends, and opportunities that fuel business growth.

-

Experts Who Get It : Our team speaks your industry’s language and knows what really matters to your customers and market.

-

Custom-Built for You : Forget one-size-fits-all. We craft research and consulting solutions as unique as your business vision.

-

Partners, Not Just Providers : We work with you, not for you — collaborating closely to turn insights into smart, strategic moves.

-

Results That Speak : Our work powers brands, startups, and industry leaders alike — with a track record of ideas that work in the real world.

Report ID: 10352519 |

Published Date: 21 Mar 2025 |

Report Format: |

Delivery Timeline: 48-72 Business Hours

More Reports from Healthcare & Pharmaceuticals Sector

Thank you for contacting us!

We have received your sample request for the research report. Our research representative will contact you shortly.

Get Free Sample Report

Oncology-Drugs-Market

JUMP TO CONTENT