Online Payment Gateway Market Analysis by Type (Hosted and Non-Hosted); by Enterprise Size (Large and Small and Medium Enterprises); and by End User (Retail & E-Commerce, BFSI, Travel & Hospitality, Media & Entertainment, and Others)-Global Supply & Demand Analysis & Opportunity Outlook 2022-2031

Report ID: 10154317 |

Published Date: 21 Mar 2025 |

Report Format: |

Delivery Timeline: 48-72 Business Hours

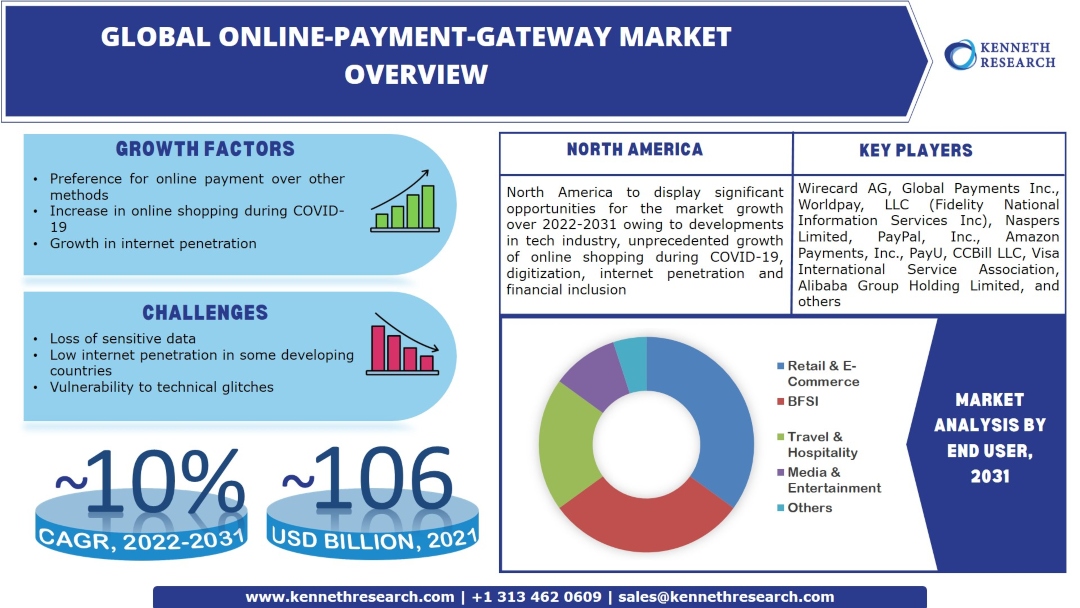

Online Payment Gateway Market Scope

|

Base Year |

2021 |

|

Forecast Year |

2022-2031 |

|

CAGR |

~10% |

|

Base Year Market Size (2021) |

~ USD 106 Billion |

|

Forecast Year Market Size (2031) |

~ USD 192 Billion |

Global Online-Payment-Gateway Market Size, Forecast, and Trend Highlights Over 2022 - 2031

The global online-payment-gateway market is estimated to garner a revenue of about USD 106 billion by the end of 2031 by growing at a CAGR of ~10% over the forecast period, i.e., 2022 – 2031. Further, the market generated a revenue of approximately USD 192 billion in the year 2021. The primary factor affecting the growth of the global online-payment-gateway market is the popular preference for online payment over cash payment. It is predicted, that by 2023, more than 20% of all global retail sales would be online sales.

GET A SAMPLE COPY OF THIS REPORT

An increase was also observed in the mobile and online purchases of goods and services, as these rose from ~18% of all purchases in 2019 to ~25% in 2020. In the same year, U.S. customers used credit cards, debit cards, or prepaid payment cards for more than 55% of their payments. As of 2021, digital or mobile wallets were used to make payments towards ~50% of e-commerce expenses, thus becoming the most preferred online payment method. Close followings are credit cards meeting ~22% and debit cards meeting ~14% of payment needs. It is estimated that by 2025 digital and mobile wallets would be used to make ~55% of e-commerce payments. To conclude, an increase in online payments is the chief factor implying a growing global online-payment-gateway market trend.

Global Online-Payment-Gateway Market: Growth Drivers and Challenges

Growth Drivers

-

Rapid Developments in Technology – Emerging tech is expected to encounter a growth rate of ~105% from 2018 to 2023. Presently there are more than 1 million tech startups worldwide. Some chief reasons driving technology adoption are general improvement of business operations (more than 40%), marketing of new business lines (~40%), improving marketing and sales (~36%), and improving standard internal procedures (more than 30%). Specific fields also show developments. For instance, machine learning is expected to power more than 8 billion voice assistants by 2024. Another domain showing great promise is artificial intelligence (AI). It is believed to be the most promising technology for innovation by more than 55% of entrepreneurs. Additionally, more than 90% of Fortune 1000 enterprises plan to make more investments in AI and big data initiatives. Technological developments aim to make the payment process more seamless for customers as time progress and thus directly contribute to the development of the global online-payment-gateway market.

-

Considerable Increase in Internet Penetration – In 2022, worldwide internet penetration exceeded 60%. It is estimated that on average more than 590000 new users connect to the internet. New internet users are growing at a rate of ~5%. Approximately 130 new devices connect to the internet every second all over the world. As an internet connection is inevitable for online transactions, the progress in internet penetration opens new opportunities for the online-payment-gateway market.

-

Rise in Online Shopping During COVID-19 – Even pre-covid, the online retail sector was showing a considerable rate of development. In 2019 approximately 14% of all retail sales globally were e-commerce sales. This rate is expected to cross 20% in 2023. Further, it has been observed that there was a surge in online shopping by ~75% and that the percentage of adults in the UK who received more parcels during lockdown than at other times was ~46%.

-

Extensive Digital Transformation of Organizations – The digital transformation of businesses is expected to increase the number of online payments and thus drive the growth of the global online-payment-gateway market. By 2018 ~56% of startups and ~40% of traditional businesses had taken up a digital business strategy. As of 2019, more than 69% of organizations were working on a digital transformation strategy or had already adopted one.

-

General Progress in Financial Inclusion – Financial inclusion is an undeniable factor driving the growth of the global online-payment-gateway market. As of 2021, more than 75% of the general population in developed regions globally owned a bank account. Among developing countries, account ownership stood at ~72%.

Challenges

-

Potential Risk of Losing Sensitive Data

-

Limited Access to the Internet in Emerging Countries

-

Apparent Vulnerability to Technical Glitches

The global online-payment-gateway market is segmented and analyzed for demand and supply by end-user into retail & e-commerce, BFSI, travel & hospitality, media & entertainment, and others. Of these, the retail & e-commerce segment is anticipated to hold the largest market size by the end of 2031. It has been observed that ~81% of global consumers are comfortable shopping in stores, while about 21% reported shopping exclusively from retail shops. ~60% of consumers prefer in-store shopping to online for the ability to touch, try and feel the product. As a part of a better risk mitigation strategy, ~40% of small business owners are concentrating more on digital sales, while a similar percentage is taking up new technologies. As of 2022, ~96% of retailers plan to invest more in digital capabilities. Similar developments can be seen in the e-commerce sector, facilitating the growth of the global online-payment-gateway market. For instance, according to the 2019 E-Stats Report by the United States Census Bureau, e-commerce shipments constituted ~68% of all manufacturing shipments in 2019, and the revenue from electronic sources came up to 8% of total revenue for service industries in the same year. Thus, the significant growth of and the progress made in the retail & e-commerce industry contributes to a growth in the global online-payment-gateway market trend

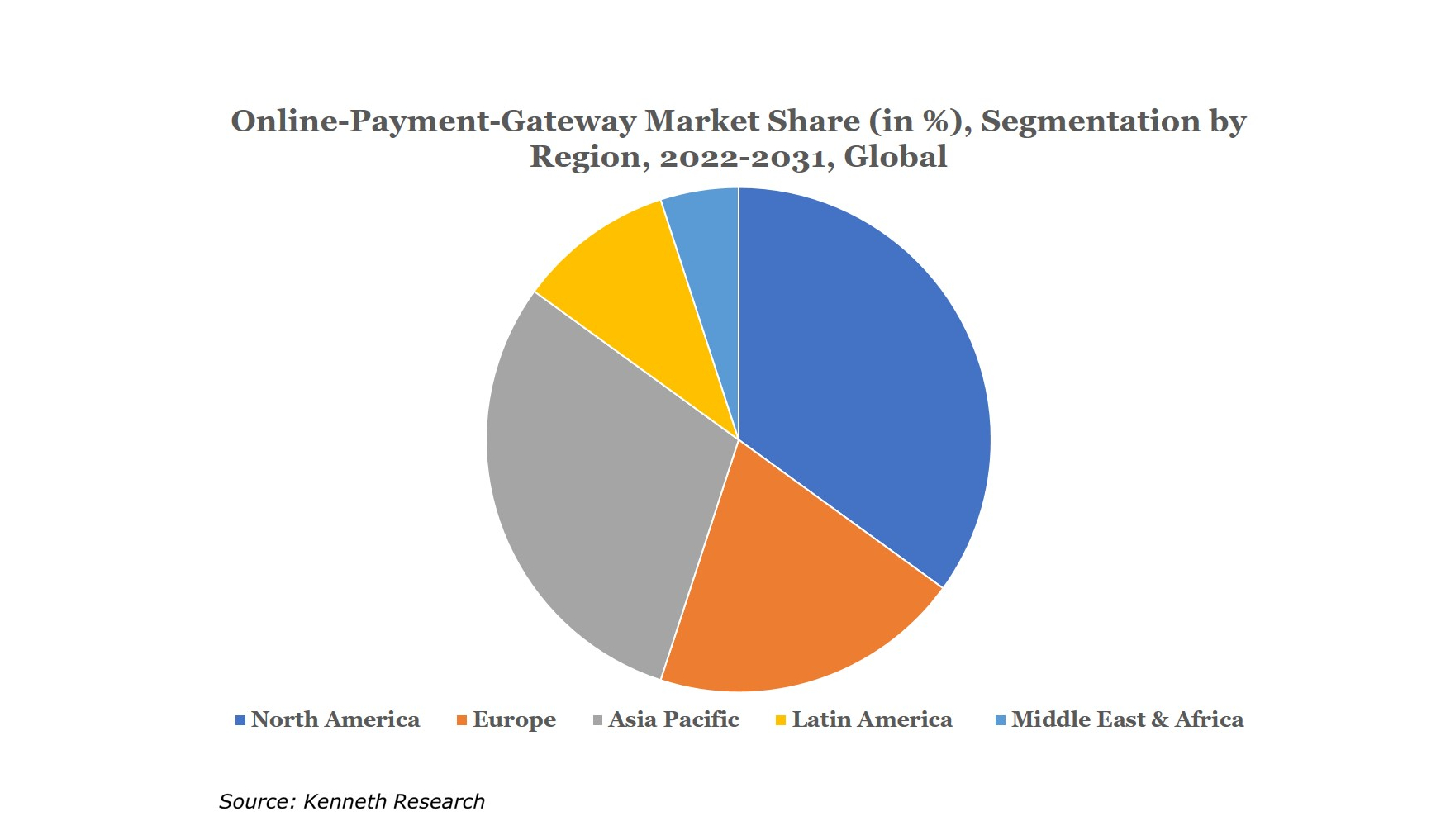

Global Online-Payment-Gateway Market Regional Synopsis

Regionally, the global online-payment-gateway market is studied into five major regions including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa region. Amongst these, the market in the North American region is projected to hold the largest market share by the end of 2031. A major factor driving the growth of the online-payment-gateway market in the region is the developments in technology, especially in the U.S. As of 2020, the U.S. tech industry employs approximately 13 million workers. However, the industry was expected to grow by more than 5% in 2021, bringing with it more than 245000 new tech jobs. The significance of online shopping in North America and its unprecedented growth during COVID-19 is another reason. In 2020 many customers in the US deliberately ordered things online due to the pandemic. These include restaurant delivery/takeout (~32%), hygiene products (~28%), clothing (~27%), food and drink (~25%), and health products (~22%). Other factors leading to the development of the online-payment-gateway market in North America are access to financial services, good internet penetration, and digitization of businesses.

Customize this Report: Request Customization

Market Segmentation

Our in-depth analysis of the global online-payment-gateway market includes the following segments:

|

By Type |

|

|

By Enterprise Size |

|

|

By End User |

|

Key Companies Dominating the Global Online-Payment-Gateway Market

Our report has covered detailed company profiling comprising company overview, business strategies, key product offerings, financial performance, key performance indicators, risk analysis, recent developments, regional presence, and SWOT analysis among other notable indicators for competitive positioning. Some of the prominent industry leaders in the global online-payment-gateway market that are included in our report are Wirecard AG, Global Payments Inc., Worldpay, LLC (Fidelity National Information Services Inc), Naspers Limited, PayPal, Inc., Amazon Payments, Inc., PayU, CCBill LLC, Visa International Service Association, Alibaba Group Holding Limited, and others.

Global Online-Payment-Gateway Market: Latest Developments

-

August, 2022: Global Payments Inc.- announced the acquisition of EVO Payments, Inc., paying USD 34.00 per share in an all-cash transaction. The merging is expected to generate a customer base of more than 1500 financial institutions and over 4.5 million merchant locations globally.

-

June, 2022: PayPal Holding - announced the introduction of PayPal Pay Monthly, a unique buy now, pay later offering to facilitate U.S. consumers to pay large purchases between USD 199-USD 10,000 as monthly payments made over a 6–24-month period.

Key Reasons to Buy Our Report

-

The report covers detailed analysis comprising market share attained by each market segment and its sub-segments.

-

It covers market dynamics including growth drivers, trends, potential opportunities, price trend analysis, and challenges that impact market growth.

-

The report includes detailed company profiles of the major players dominating the market.

-

We use effective research methodologies to calculate the market numbers and provide value-added assessments for overall growth.

-

We provide customized reports as per the clients’ requirements helping them to see possible and unexpected challenges and unforeseen opportunities in order to help them reach their goal.

Frequently Asked Question

The market is segmented by type, enterprise size, end user and by region.

The retail & e-commerce segment is anticipated to garner the largest market size by the end of 2031 and display significant growth opportunities.

Why Choose Kenneth Research ?

-

Insight with Impact : We don’t just gather data — we uncover stories, trends, and opportunities that fuel business growth.

-

Experts Who Get It : Our team speaks your industry’s language and knows what really matters to your customers and market.

-

Custom-Built for You : Forget one-size-fits-all. We craft research and consulting solutions as unique as your business vision.

-

Partners, Not Just Providers : We work with you, not for you — collaborating closely to turn insights into smart, strategic moves.

-

Results That Speak : Our work powers brands, startups, and industry leaders alike — with a track record of ideas that work in the real world.

Report ID: 10154317 |

Published Date: 21 Mar 2025 |

Report Format: |

Delivery Timeline: 48-72 Business Hours

More Reports from ICT & Telecom Sector

Thank you for contacting us!

""We have received your sample request for the research report. Our research representative will contact you shortly.""

Get a free sample of this report

Online Payment Gateway Market

JUMP TO CONTENT