SCADA Oil and Gas Market Analysis by Architecture (Hardware, Software, and Services); and by Stream (Upstream, Midstream, and Downstream)-Global Supply & Demand Analysis & Opportunity Outlook 2023-2033

Report ID: 10352476 |

Published Date: 21 Mar 2025 |

Report Format: |

Delivery Timeline: 48-72 Business Hours

SCADA Oil and Gas Market Scope Report

|

Base Year |

2022 |

|

Forecast Year |

2023-2033 |

|

CAGR |

~6% |

|

Base Year Market Size (2022) |

~ USD 5 Billion |

|

Forecast Year Market Size (2033) |

~ USD 7 Billion |

Global SCADA Oil and Gas Market Size, Forecast, and Trend Highlights Over 2023 - 2033

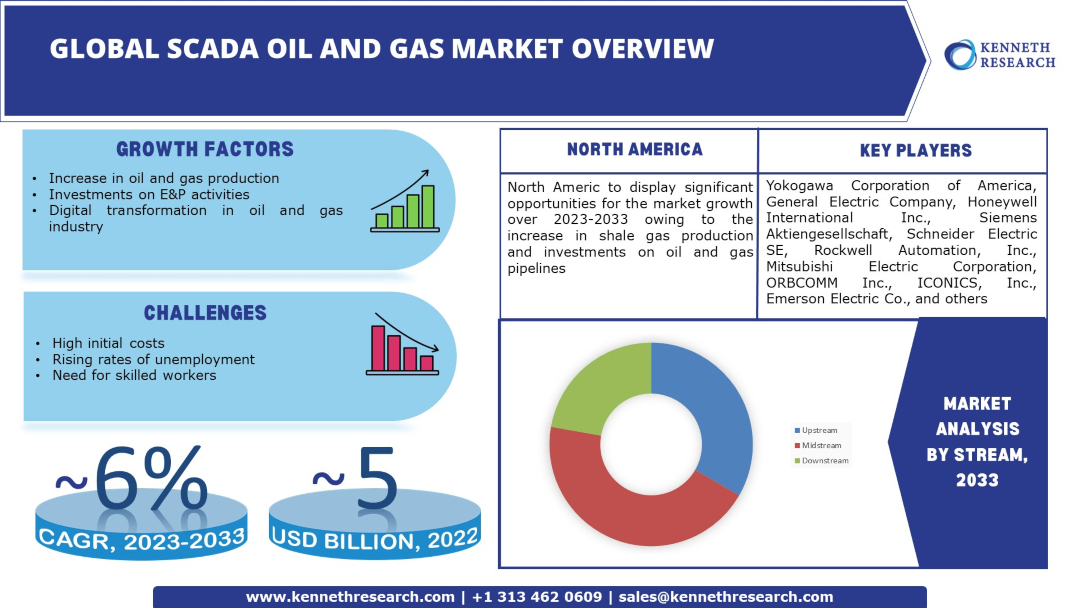

The global SCADA oil and gas market is estimated to garner a revenue of ~ USD 7 billion by the end of 2033 by growing at a CAGR of ~6% over the forecast period, i.e., 2023 – 2033. Further, the market generated a revenue of ~ USD 5 billion in the year 2022. Supervisory Control and Data Acquisition (SCADA) is a set of software applications that helps in the appropriate management of industrial production processes. The increasing production of oil and natural gas is the primary factor driving the growth of the global SCADA oil and gas market. For instance, dry gas production in the United States (U.S.) is anticipated to rise to ~97 billion cubic feet per day (bcfd) in 2022 compared to ~94 bcfd in 2021.

GET A SAMPLE COPY OF THIS REPORT

Oil and gas SCADA lets operators monitor the production at gas wells and pipelines efficiently with automatic alerts for any issue. This helps the oil and gas industry to improve performance and optimize processes and resources to meet the increasing demand.

Global SCADA Oil and Gas Market: Growth Drivers and Challenges

Growth Drivers

-

Huge Investments Made Towards Exploration and Production (E&P) Activities – The investments made towards E&P in the oil industry in 2019 have been estimated to be ~ USD 541 billion. It is the E&P companies that find and extract the raw materials utilized in energy industries. They then ship these materials to the oil refineries for production processes. With the oil and gas SCADA system, operators can easily collect data about remote oil and gas sites and save the personnel visits otherwise required in the upstream, midstream, and downstream production of oil and gas.

-

Large-scale Digital Transformation in the Oil and Gas Sector – The oil and gas industry has been projected to invest ~ USD 12 billion yearly on analytics and cloud computing by 2030.

-

Rising Adoption of Smart Devices in Critical Infrastructure Sectors – As per recent statistics, it's predicted that 50 billion gadgets will be online by 2020. Industry 4.0 is bringing about a time when IoT systems are replaced by SCADA, which has historically been used for production automation and data sharing.

-

Increased Spending on Data Centers – An increase of about 11% has been observed in global spending on data center systems in 2022 compared to the previous year.

Challenges

-

Need for High Initial Investments

-

Concerns Over Increasing Unemployment Rate

-

Immense Need for Skilled Operators, Programmers, and Analysts

The global SCADA oil and gas market is segmented and analyzed for demand and supply by stream into upstream, midstream, and downstream. Of these, the midstream segment is anticipated to hold the largest market size by the end of 2033. The segmental growth is accelerated by the huge investments made towards the infrastructure development in oil pipelines that transport oil and gas from the extraction site to the refineries. As of 2022, the total capital expenditure on new pipelines has been estimated to amount to ~ USD 486 billion.

Global SCADA Oil and Gas Market Regional Synopsis

Regionally, the global SCADA oil and gas market is studied into five major regions including North America, Europe, Asia Pacific, Latin America and Middle East & Africa region. Amongst these markets, the market in the North American region is projected to hold the largest market share by the end of 2033. The large-scale production of shale gas and the investments in oil pipelines are the primary factors driving the regional market growth. According to the U.S. Energy Information Administration (EIA), the U.S. dry shale gas production in 2021 amounted to ~27 trillion cubic feet (Tcf).

Market Segmentation

Our in-depth analysis of the global SCADA oil and gas market includes the following segments:

|

By Architecture |

|

|

By Stream |

|

Key Companies Dominating the Global SCADA Oil and Gas Market

Our report has covered detailed company profiling comprising company overview, business strategies, key product offerings, financial performance, key performance indicators, risk analysis, recent developments, regional presence, and SWOT analysis among other notable indicators for competitive positioning. Some of the prominent industry leaders in the global SCADA oil and gas market that are included in our report are Yokogawa Corporation of America, General Electric Company, Honeywell International Inc., Siemens Aktiengesellschaft, Schneider Electric SE, Rockwell Automation, Inc., Mitsubishi Electric Corporation, ORBCOMM Inc., ICONICS, Inc., Emerson Electric Co., and others.

Global SCADA Oil and Gas Market: Latest Developments

-

October, 2022: Emerson Electric Co announced the release of Movicon.NExT 4.2., its advanced SCADA-based software that is capable of improving operational excellence in several applications, including hybrid and discrete manufacturing.

-

February, 2022: General Electric Company announced the launch of the latest version of its HMI/SCADA software, CIMPLICITY 2022.

Key Reasons to Buy Our Report

-

The report covers detailed analysis comprising market share attained by each market segment and its sub-segments.

-

It covers market dynamics including growth drivers, trends, potential opportunities, price trend analysis and challenges that impact the market growth.

-

The report includes detailed company profiles of the major players dominating the market.

-

We use effective research methodologies to calculate the market numbers and provide value-added assessment for overall growth.

-

We provide customized reports as per the clients’ requirement helping them to see possible and unexpected challenges and unforeseen opportunities in order to help them reach their goal.

Frequently Asked Question

The market is segmented by architecture, stream, and by region.

The midstream segment is anticipated to garner the largest market size by the end of 2033 and display significant growth opportunities.

Why Choose Kenneth Research ?

-

Insight with Impact : We don’t just gather data — we uncover stories, trends, and opportunities that fuel business growth.

-

Experts Who Get It : Our team speaks your industry’s language and knows what really matters to your customers and market.

-

Custom-Built for You : Forget one-size-fits-all. We craft research and consulting solutions as unique as your business vision.

-

Partners, Not Just Providers : We work with you, not for you — collaborating closely to turn insights into smart, strategic moves.

-

Results That Speak : Our work powers brands, startups, and industry leaders alike — with a track record of ideas that work in the real world.

Report ID: 10352476 |

Published Date: 21 Mar 2025 |

Report Format: |

Delivery Timeline: 48-72 Business Hours

More Reports from Energy & Power Sector

Thank you for contacting us!

We have received your sample request for the research report. Our research representative will contact you shortly.

Get Free Sample Report

SCADA-Oil-and-Gas-Market

JUMP TO CONTENT