Speciality Polyamides Market Segmentation by Type (Polyamide 6/10, Polyamide 6/12, Polyamide 10, Polyamide 11, and Polyamide 12); by Application (Automotive & Transportation, Electrical & Electronics, Consumer Goods & Retail, Energy, and Industrial Coatings)-Global Demand Analysis & Opportunity Outlook 2031

Report ID: 10070757 |

Published Date: 21 Mar 2025 |

Report Format: |

Delivery Timeline: 48-72 Business Hours

Global Speciality Polyamides Market Highlights Over 2022 - 2031

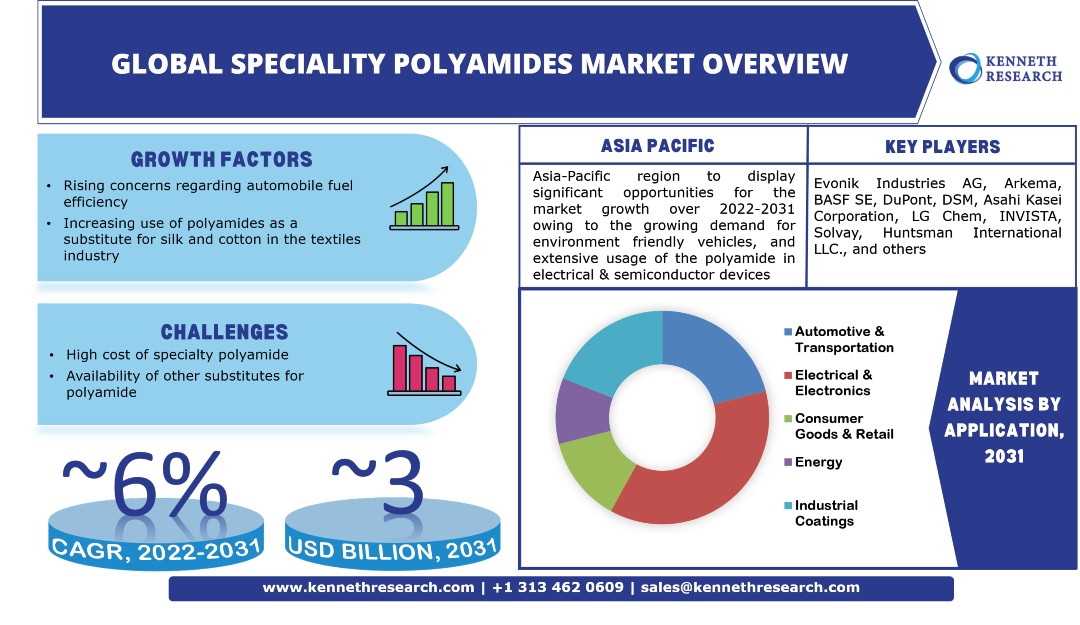

The global speciality polyamides market is estimated to garner around USD 3 billion in revenue by 2031 by growing at a CAGR of nearly 6% over the forecast period, i.e., 2022 – 2031. The market's growth can be attributed to the increasing use of polyamides as a substitute for silk and cotton in the textiles industry. For instance, according to International Cotton Advisory Committee (ICAC), the global production of cotton declined from 27 million metric tonnes in 2017 to 24.3 million metric tonnes in 2020. Further, the production of silk also declined globally, from over 1,77,500 metric tonnes in 2017 to nearly 90,000 metric tonnes in 2020.

GET A SAMPLE COPY OF THIS REPORT

Additionally, rising concerns regarding automobile fuel efficiency, wide use of polyamides in the packaging industry owing to their properties, and high demand for green solutions are also expected to propel the market growth. Moreover, favorable government regulations regarding the polyamides applications in the automotive, textile, and consumer goods industries is also vital factor accelerating market growth.

The COVID-19 pandemic had a negative impact on the speciality polyamides market on the back of the various economic and legal restrictions imposed by many countries across the world. The decline in the growth of the construction industry, automotive industry, electrical and electronics industry highly affected the market which impacted the demand for specialty polyamides.

However, the high cost of specialty polyamides, and availability of other substitutes for polyamide are the key factors restraining the growth of the market.

The market is segmented by application into automotive & transportation, electrical & electronics, consumer goods & retail, energy, and industrial coatings. Out of these segments, the electrical & electronics segment is anticipated to hold the major share over the forecast period on the back of the wide use of polyamides in electronic devices. Further, components are getting smaller in these devices, which dispose high amounts of heat. Production of smartphones, semiconductors, IT solution services, and others is also growing. As of 2020, over 45% of the world’s population owned a smartphone. Therefore, these factors are increasing the demand for thermally conductive plastics.

Global Speciality Polyamides Market Regional Synopsis

Regionally, the global speciality polyamides market is segmented into five major regions including North America, Europe, Asia Pacific, Latin America and Middle East & Africa region. The market in Asia Pacific region is estimated to witness significant growth over the forecast period on the back of the growing demand for environment friendly vehicles. For instance, electric vehicles on road increased from over 1 million units in 2016 to nearly 7 million vehicles in 2020.

Additionally, expansion of the automobile industry in the region, and increasing availability of low-cost raw materials and labor are predicted to drive the market growth. Moreover, extensive usage of the polyamide in electrical & semiconductor devices, and increasing disposable income of consumers are further expected to propel the market growth in the region.

Further, the increasing production of electronics and IT industries is also contributing to market growth. For instance, in 2020, the total global production by the electronics and IT industries increased by nearly 2%.

North America is anticipated to witness substantial growth over the forecast period on the back of the increasing awareness regarding the usage of eco-friendly substances, rising specialty polyamides usage in automotive industry, and expanding specialty polyamides requirements in consumer goods and electronics industries.

Market Segmentation

Our in-depth analysis of the global speciality polyamides market includes the following segments:

By Type

-

Polyamide 6/10

-

Polyamide 6/12

-

Polyamide 10

-

Polyamide 11

-

Polyamide 12

By Application

-

Automotive & Transportation

-

Electrical & Electronics

-

Consumer Goods & Retail

-

Energy

-

Industrial Coatings

Growth Drivers and Challenges Impacting the Growth of the Global Speciality Polyamides Market

Growth Drivers

-

Rising concerns regarding automobile fuel efficiency

-

Increasing use of polyamides as a substitute for silk and cotton in the textiles industry

-

High demand for green solutions

Challenges

-

High cost of specialty polyamides

-

Availability of other substitutes for polyamide

Key Companies Dominating the Global Speciality Polyamides Market

Our report has covered detailed company profiling comprising company overview, business strategies, key product offerings, financial performance, key performance indicators, risk analysis, recent developments, regional presence, and SWOT analysis among other notable indicators for competitive positioning. Some of the prominent industry leaders in the global speciality polyamides market that are included in our report are Evonik Industries AG, Arkema, BASF SE, DuPont, DSM, Asahi Kasei Corporation, LG Chem, INVISTA, Solvay, Huntsman International LLC., and others.

Latest Developments in the Global Speciality Polyamides Market:

-

March 2020: Huntsman International LLC. acquired the CVC Thermoset Specialties, a North American specialty chemical manufacturing company to expand its specialty chemicals portfolio.

-

January 2020: BASF SE acquired Solvay’s polyamide (PA 6.6) business to broaden their polyamide capabilities with innovative and well-known products to provide better engineering plastics solutions.

Key Reasons to Buy Our Report

-

The report covers detailed analysis comprising market share attained by each market segment and its sub-segments.

-

It covers market dynamics including growth drivers, trends, potential opportunities, price trend analysis and challenges that impact the market growth.

-

The report includes detailed company profiles of the major players dominating the market.

-

We use effective research methodologies to calculate the market numbers and provide value-added assessment for overall growth.

-

We provide customized reports as per the clients’ requirement helping them to see possible and unexpected challenges and unforeseen opportunities in order to help them reach their goal.

Frequently Asked Question

The market is segmented by type, application, and by region.

The electrical & electronics segment is anticipated to hold largest market size in value and display significant growth opportunities.

Why Choose Kenneth Research ?

-

Insight with Impact : We don’t just gather data — we uncover stories, trends, and opportunities that fuel business growth.

-

Experts Who Get It : Our team speaks your industry’s language and knows what really matters to your customers and market.

-

Custom-Built for You : Forget one-size-fits-all. We craft research and consulting solutions as unique as your business vision.

-

Partners, Not Just Providers : We work with you, not for you — collaborating closely to turn insights into smart, strategic moves.

-

Results That Speak : Our work powers brands, startups, and industry leaders alike — with a track record of ideas that work in the real world.

Report ID: 10070757 |

Published Date: 21 Mar 2025 |

Report Format: |

Delivery Timeline: 48-72 Business Hours

More Reports from Chemicals Sector

Thank you for contacting us!

""We have received your sample request for the research report. Our research representative will contact you shortly.""

Get a free sample of this report

Speciality Polyamides Market

JUMP TO CONTENT