Wealth-Management-Platform Market Analysis by Advisory Model (Human Advisory, Robo Advisory, and Hybrid); by Business Function (Performance Management, Reporting, and Others); by Deployment (Cloud and On-Premise); and by End User (Banks, Brokerage Firms, and Others)-Global Supply & Demand Analysis & Opportunity Outlook 2022-2031

Report ID: 10154320 |

Published Date: 21 Mar 2025 |

Report Format: |

Delivery Timeline: 48-72 Business Hours

Global Wealth Management Platform Market Scope

|

Base Year |

2021 |

|

Forecast Year |

2022-2031 |

|

CAGR |

~13% |

|

Base Year Market Size (2021) |

~ USD 2 Billion |

|

Forecast Year Market Size (2031) |

~ USD 12 Billion |

Global Wealth-Management-Platform Market Size, Forecast, and Trend Highlights Over 2022 - 2031

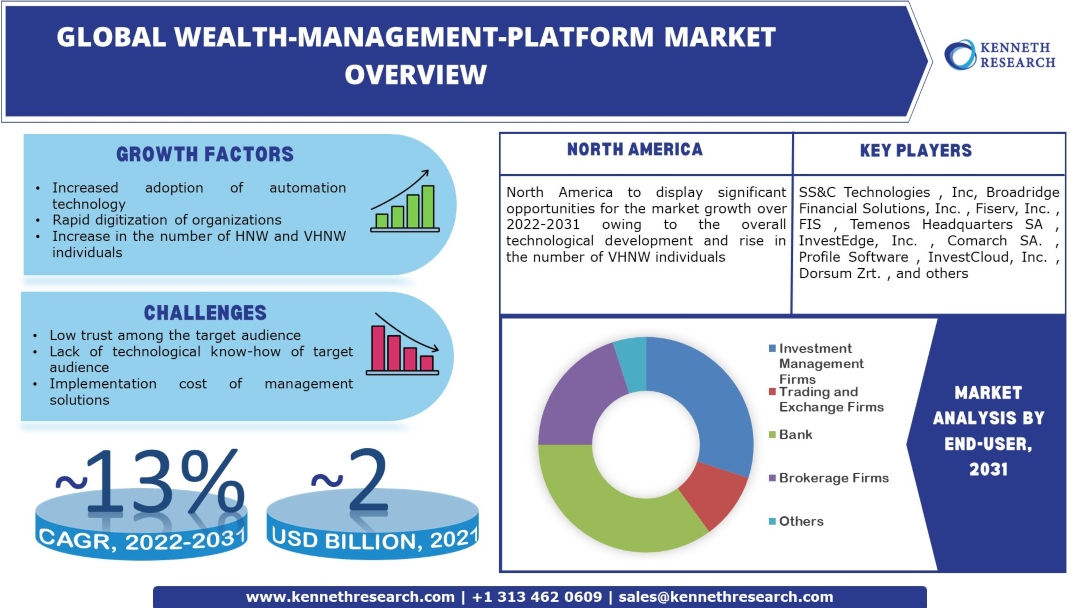

The global wealth-management-platform market is estimated to garner a revenue of ~ USD 12 billion by the end of 2031 by growing at a CAGR of ~13% over the forecast period, i.e., 2022 – 2031. Further, the market generated a revenue of ~USD 2 billion in the year 2021. A wealth management platform acts as an advisor platform and offers a comprehensive wealth overview, portfolio management capabilities, and financial goal planning of the client. The growth of the global wealth-management-platform market can be primarily attributed to the adoption of automation in the financial sector. It has been estimated that ~51% of the chief executive officers (CEOs) of banking and financial organizations are trying to simplify operations and products by taking up process automation.

GET A SAMPLE COPY OF THIS REPORT

It was observed that ~89% of executives in financial services and ~77% of the executives in the technology sectors had been reporting increased implementation of automation technology since the onset of COVID-19. Additionally, the interaction between robots and humans in the financial sector is predicted to reach a ~91% success rate by 2022, leading to a larger global wealth-management-platform market size. Irrespective of the sector, wealth management systems are beneficial for many reasons, including increased efficiency in business processes, compliance with regulatory requirements, streamlined and improved business, and standardization of services.

Global Wealth-Management-Platform Market: Growth Drivers and Challenges

Growth Drivers

-

Rapid Growth in Digitization - As of 2020, digitalization was placed as the top priority for chief information officers (CIOs) by ~40% of CEOs. In 2019, ~71% of businesses either had a well-thought-out digital transformation strategy or were working on the same. However, in 2018 itself, ~56% of startups and ~39% of traditional businesses had implemented digital business strategies. Thus, it is observed that businesses worldwide are increasingly implementing digital transformation for its benefits, including quick access to information, increased productivity, better relationship with customers, reduced operational costs, and improved information security. This rapid digitization could result in the greater adoption of wealth-management tools in the end-user sector of many organizations.

-

Technological development in Artificial Intelligence (AI) - AI can monitor customers' spending and give appropriate recommendations to them. As of 2022, ~92% of businesses reported ongoing investments in AI, and ~92% of these are increasing their investments. Organizations invest in AI for benefits, including better productivity, business insights, customer service, and more.

-

Technological Developments in Blockchain - Blockchain can bring amazing transformations to wealth management by transforming information technology (IT) infrastructures and service offerings. ~97% of financial service experts are observed to believe that blockchain has attained mainstream adoption. Blockchain is believed to be essential in the future for verifying the identity of customers by ~53% of experts. Additionally, between 2022 and 2030, blockchain is predicted to grow at ~86%.

-

Effective Adoption of Analytics - Wealth management relies considerably on data analytics as it provides information vital to planning and strategizing and thus gives a competitive edge to firms. So, the growth of data analytics is inevitable for large wealth-management-platform market sizes. Approximately 81% of organizations invest in data analytics while ~95% of business analysts and businesses acknowledge the significance of data and analytics in the digitalization of the company.

-

Sudden Rise of High-Net-Worth (HNW) And Very High Net Worth (VHNW) Individuals- HNWIs and VHNWIs demand more transparency in the management of their finance and wealth-management platforms assures them. In 2021 the number of HNWIs in North America and the Asia Pacific exceeded 7 million. Additionally, even amidst the pandemic, the VHNWI population rose ~2% from 2019 to reach ~3 million.

Challenges

-

Lack of Awareness About the Technology Among the Target Audience

-

Target Audience Showing Inadequate Trust in the Solutions

-

High Cost for the Implementation of Wealth-management-platforms

The global wealth-management-platform market is segmented and analyzed for demand and supply by end-user into investment management firms, trading and exchange firms, banks, brokerage firms, and others. Among these, the bank segment is anticipated to hold the largest market size by the end of 2031. The market growth can be primarily attributed to an increased usage of mobile banking and online banking. For instance, ~90% of mobile banking customers employ online banking at least once a month. Additionally, it has been predicted that the total number of mobile and online banking users will reach ~4 billion by 2024. Another reason is the growing population of VHNW population in the region. VHNW individuals who make investments mostly opt for wealth management platforms for their transparency and thus contribute to the growth of the global wealth-management-platform market size. Further, banking and finance are the top industries in the three leading regions for VHNW individuals - Europe, Asia, and North America.

Global Wealth-Management-Platform Market Regional Synopsis

Regionally, the global wealth-management-platform market is studied into five major regions including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa region. Amongst these markets, the market in the North American region is projected to hold the largest market share by the end of 2031. The overall development of technology and the increase in the number of VHNW individuals are the primary factors driving the growth of the wealth-management-platform market in the region. Canada and the United States (U.S.) were two regions to launch flagship digital-government initiatives in the 1990s. Later, throughout the years till the present, there has been a rapid increase in the number of online government services. This was facilitated mainly because of the rapid internet penetration growth in these regions from ~51% in 2000 to ~94% and ~96% in the U.S. and Canada respectively. It has been observed that despite the pandemic, digitization in North America grew in leaps and bounds for ~61% of its services and products to be fully or partially digitized. The U.S. has also been showing developments in AI technology. As for the VHNW individuals, their population in North America, rose ~7% from 2019, to exceed 1 million and constitute up to 42% of the global total.

Customize this Report: Request Customization

Market Segmentation

Our in-depth analysis of the global wealth-management-platform market includes the following segments:

|

By Advisory Model |

|

|

By Business Function |

|

|

By Deployment |

|

|

By End-User |

|

Key Companies Dominating the Global Wealth-Management-Platform Market

Our report has covered detailed company profiling comprising company overview, business strategies, key product offerings, financial performance, key performance indicators, risk analysis, recent developments, regional presence, and SWOT analysis among other notable indicators for competitive positioning. Some of the prominent industry leaders in the global wealth-management-platform market that are included in our report are SS&C Technologies, Inc, Broadridge Financial Solutions, Inc., Fiserv, Inc., FIS, Temenos Headquarters SA, InvestEdge, Inc., Comarch SA., Profile Software, InvestCloud, Inc., Dorsum Zrt., and others.

Global Wealth-Management-Platform Market: Latest Developments

-

July, 2022: FIS - announced the launching in the U.K. enhanced wealth management solutions with self-invested personal pension (SIPP) servicing in collaboration with Quai Digital. Quai will in turn enhance its infrastructure and services by utilizing FIS's wealth management and service solutions to operate its investment businesses and savings.

-

March, 2022: SS&C Technologies, Inc - announced a long-term partnership with AMP, an Australian wealth management company to offer technology services for its North investment platform.

Key Reasons to Buy Our Report

-

The report covers a detailed analysis comprising market share attained by each market segment and its sub-segments.

-

It covers market dynamics including growth drivers, trends, potential opportunities, price trend analysis, and challenges that impact market growth.

-

The report includes detailed company profiles of the major players dominating the market.

-

We use effective research methodologies to calculate the market numbers and provide value-added assessments for overall growth.

-

We provide customized reports as per the client's requirement helping them to see possible and unexpected challenges and unforeseen opportunities in order to help them reach their goal.

Frequently Asked Question

The market is segmented by advisory model, business function, deployment, end-user, and by region.

The banks segment is anticipated to garner the largest market size by the end of 2031 and display significant growth opportunities.

Why Choose Kenneth Research ?

-

Insight with Impact : We don’t just gather data — we uncover stories, trends, and opportunities that fuel business growth.

-

Experts Who Get It : Our team speaks your industry’s language and knows what really matters to your customers and market.

-

Custom-Built for You : Forget one-size-fits-all. We craft research and consulting solutions as unique as your business vision.

-

Partners, Not Just Providers : We work with you, not for you — collaborating closely to turn insights into smart, strategic moves.

-

Results That Speak : Our work powers brands, startups, and industry leaders alike — with a track record of ideas that work in the real world.

Report ID: 10154320 |

Published Date: 21 Mar 2025 |

Report Format: |

Delivery Timeline: 48-72 Business Hours

More Reports from ICT & Telecom Sector

Thank you for contacting us!

""We have received your sample request for the research report. Our research representative will contact you shortly.""

Get a free sample of this report

Wealth Management Platform Market

JUMP TO CONTENT